TCS

How to fill Schedule TCS?

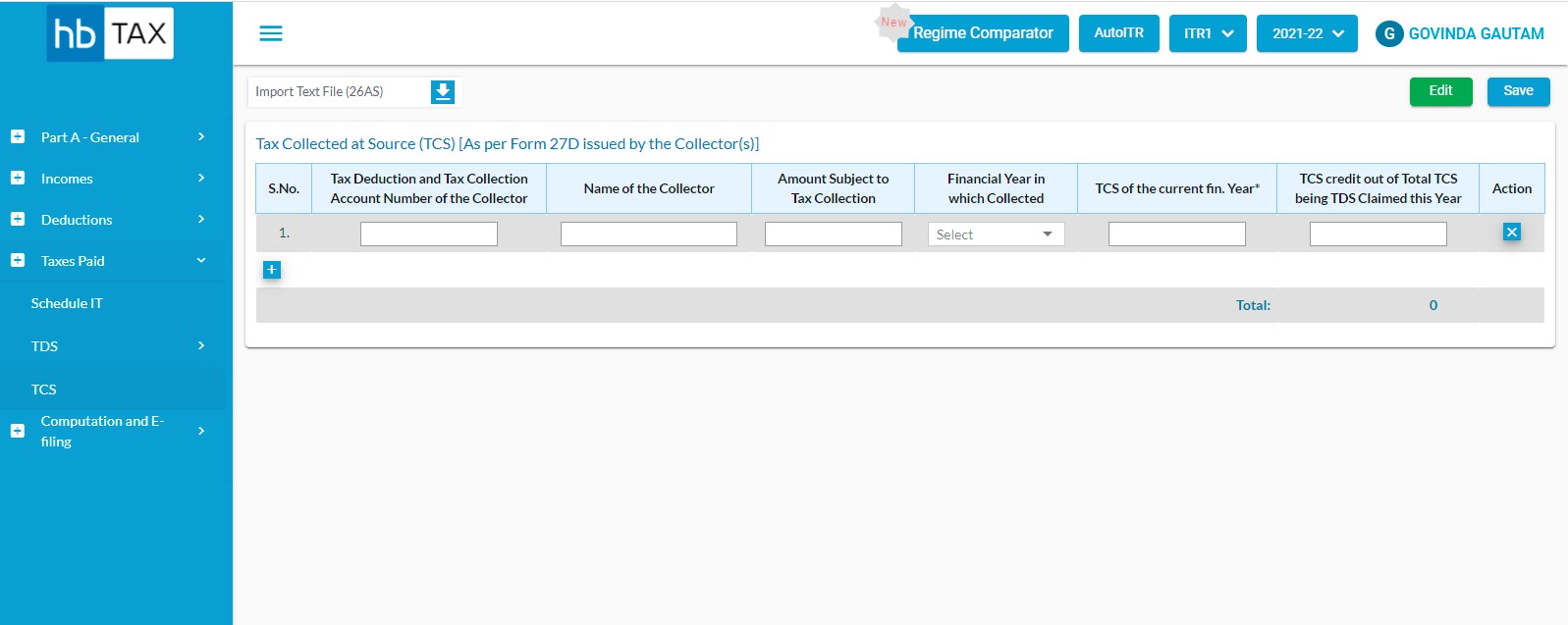

Taxes Paid -> Click on Schedule TCS tab

You are required to fill following fields:-

- Tax Deduction and Tax Collection Account Number of the Collector

- Name of the Collector

- Amount Subject to Tax Collection

- Financial Year in which Collected

- TCS of the current fin. Year

- TCS credit out of Total TCS being TDS Claimed this Year

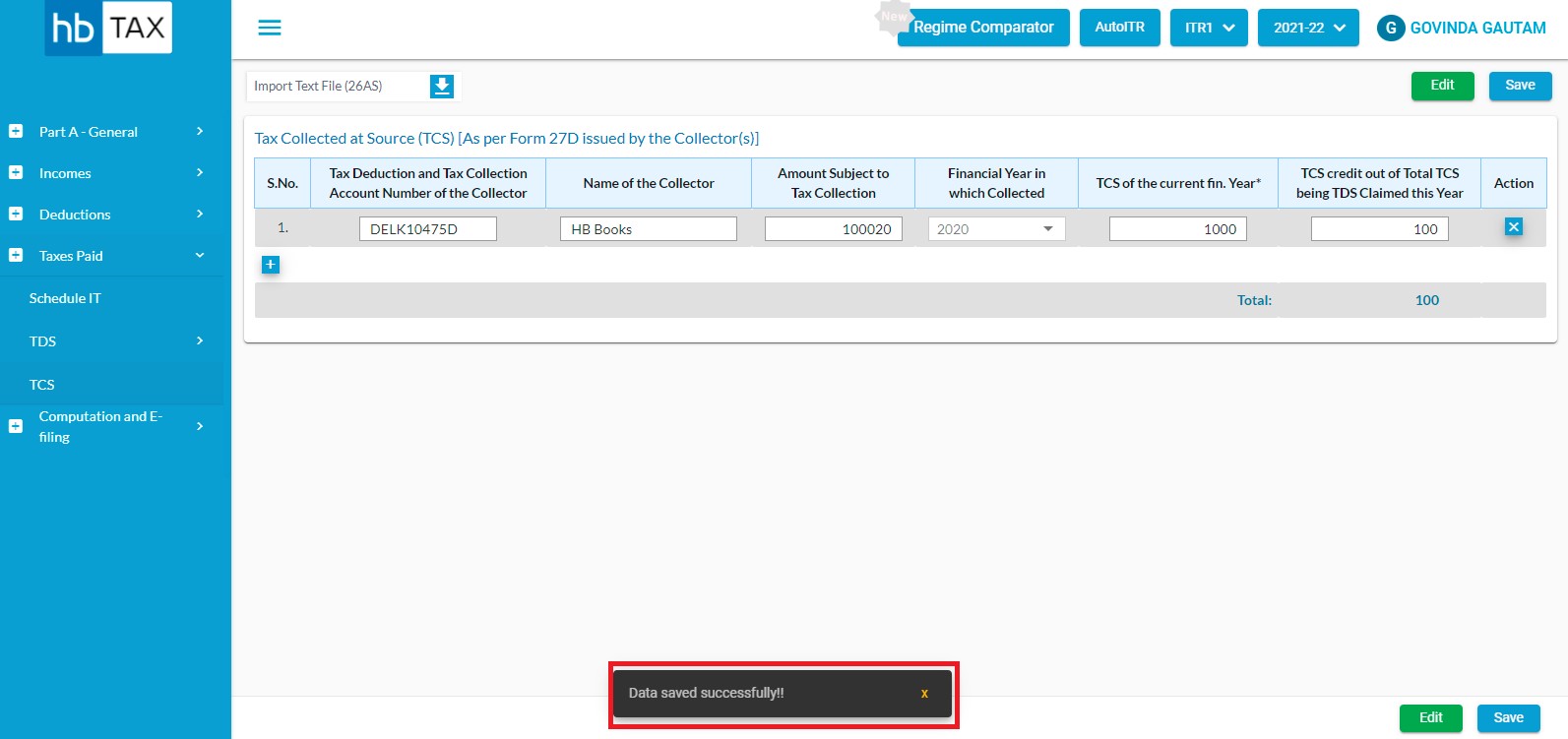

After entering necessary information, click on Save.

A message will appear as "Data Saved Successfully".

What Mandatory fields are required?

For Schedule TCS you are required to fill some mandatory fields such as:-

- Tax Deduction and Tax Collection Account Number of the Collector

- Name of the Collector

- Amount Subject to Tax Collection

- Financial Year in which Collected

- TCS of the current fin. Year

- TCS credit out of Total TCS being TDS Claimed this Year

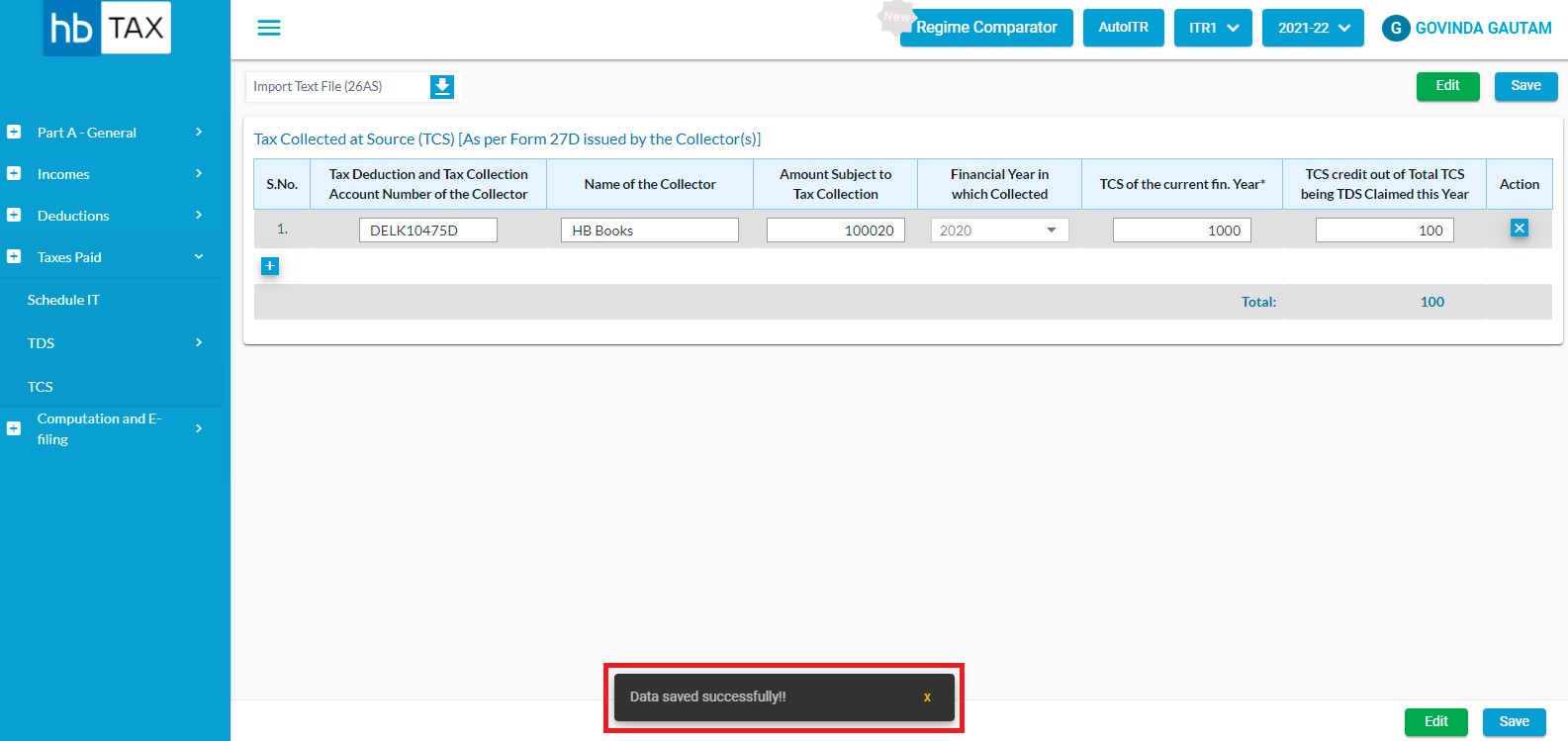

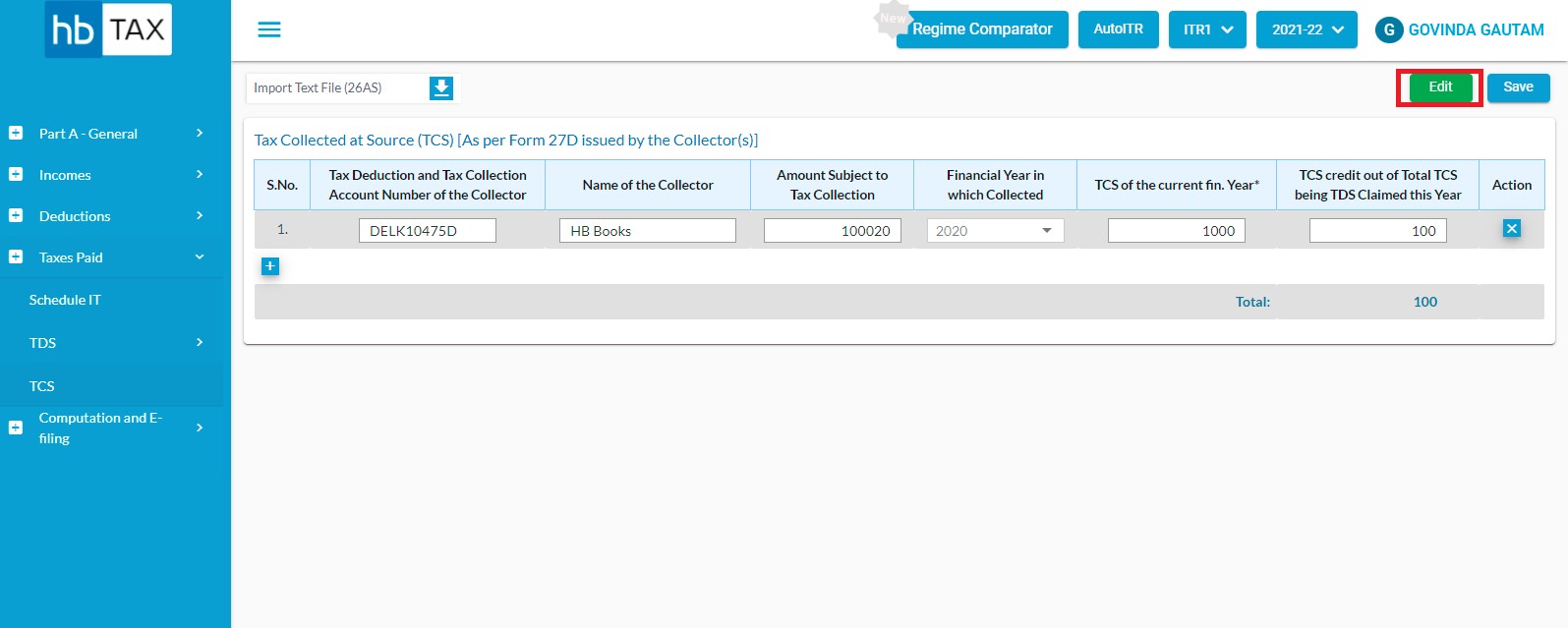

How to edit Schedule TCS?

In order to edit Schedule TCS page, user is required to click on "Edit"

After clicking on Edit, user can edit the information such as Name of the Collector, Amount Subject to Tax Collection, Financial Year in which Collected and CS credit out of Total TCS being TDS Claimed this Year etc.

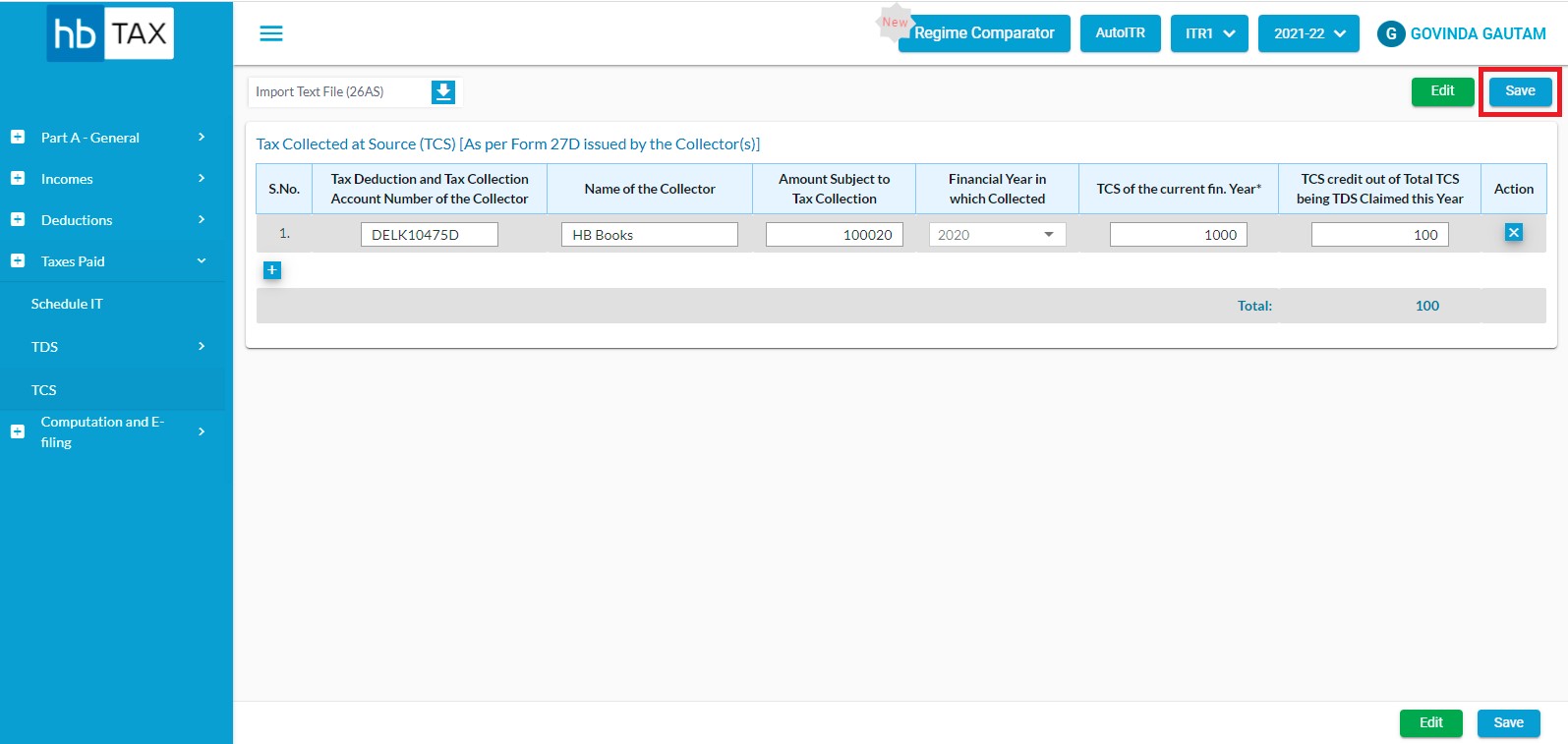

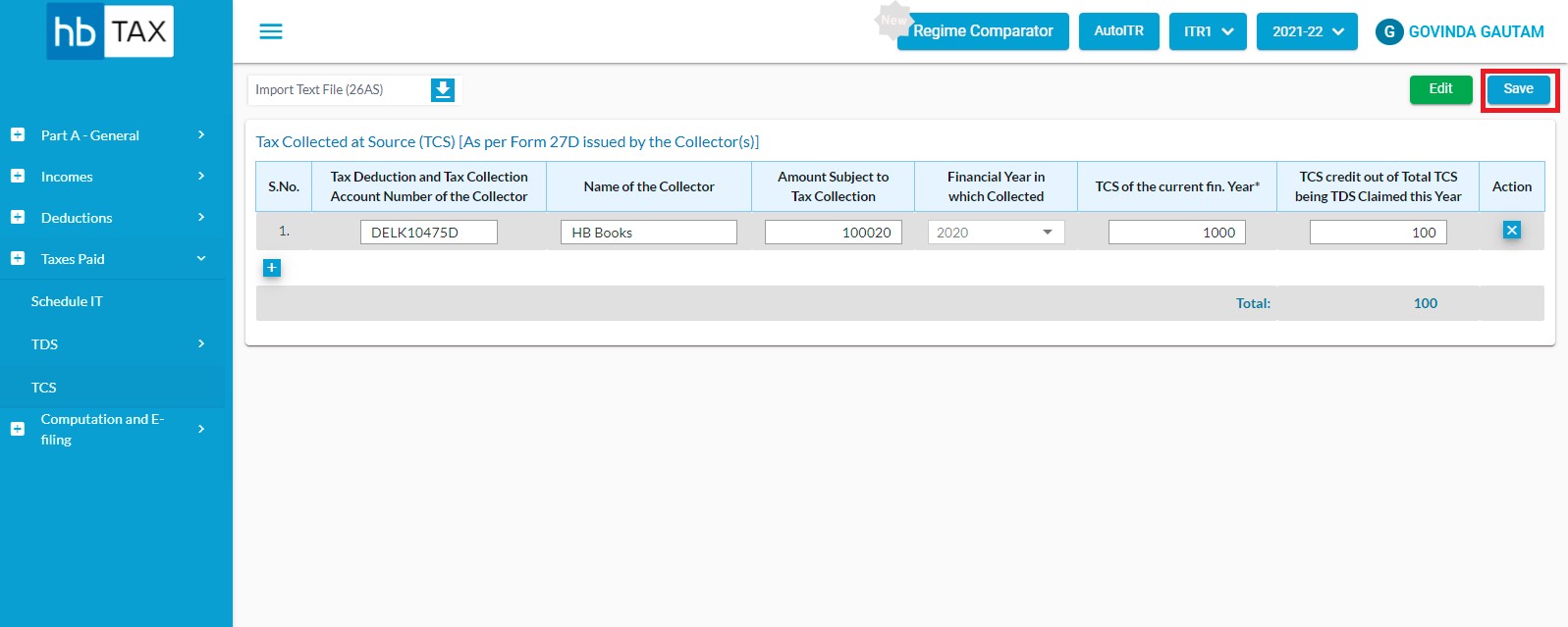

How to save Schedule TCS?

In order to save the Schedule TCS page, user is required to click on "Save"

After clicking on "Save", a message will appear as "Data Saved Successfully".