Return

How do I file GSTR-7 Returns?

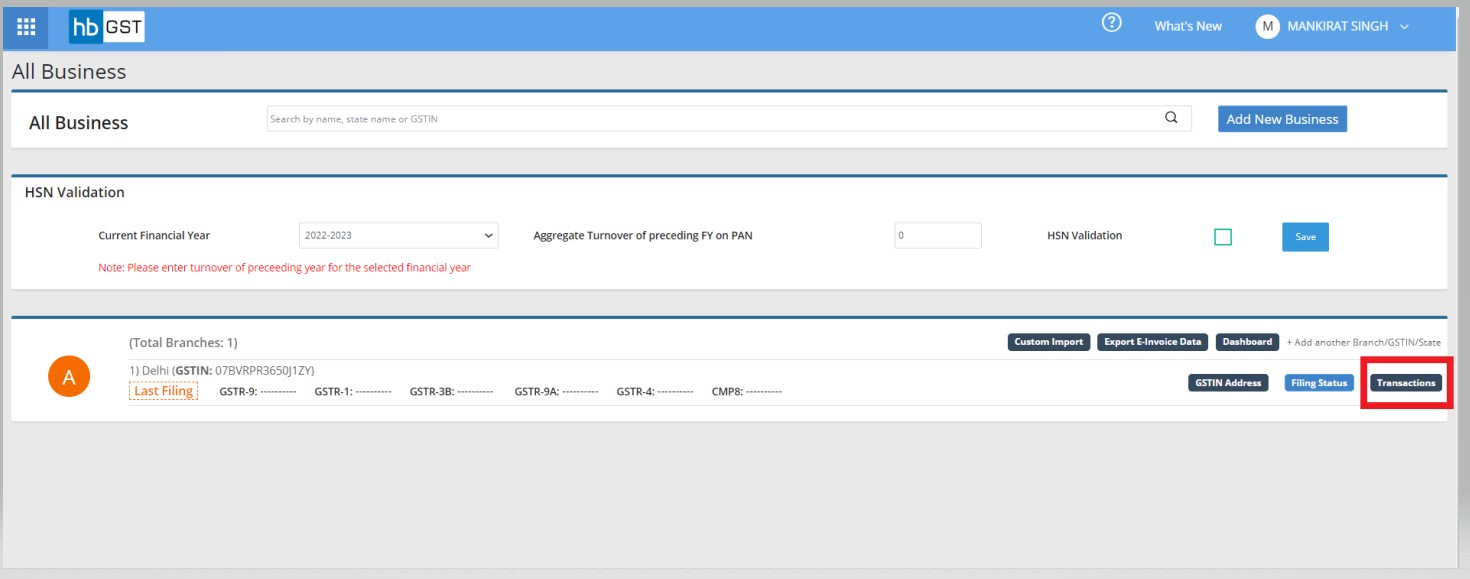

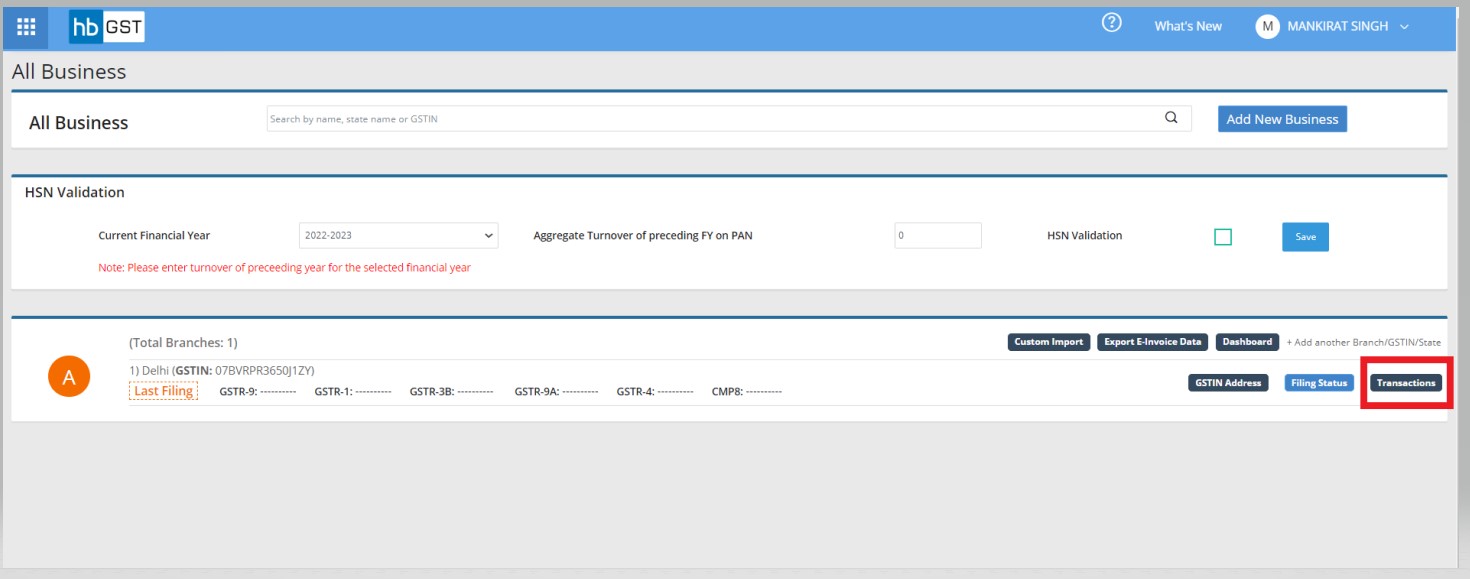

Step 1: Click on the "Transactions" button after entering into the business

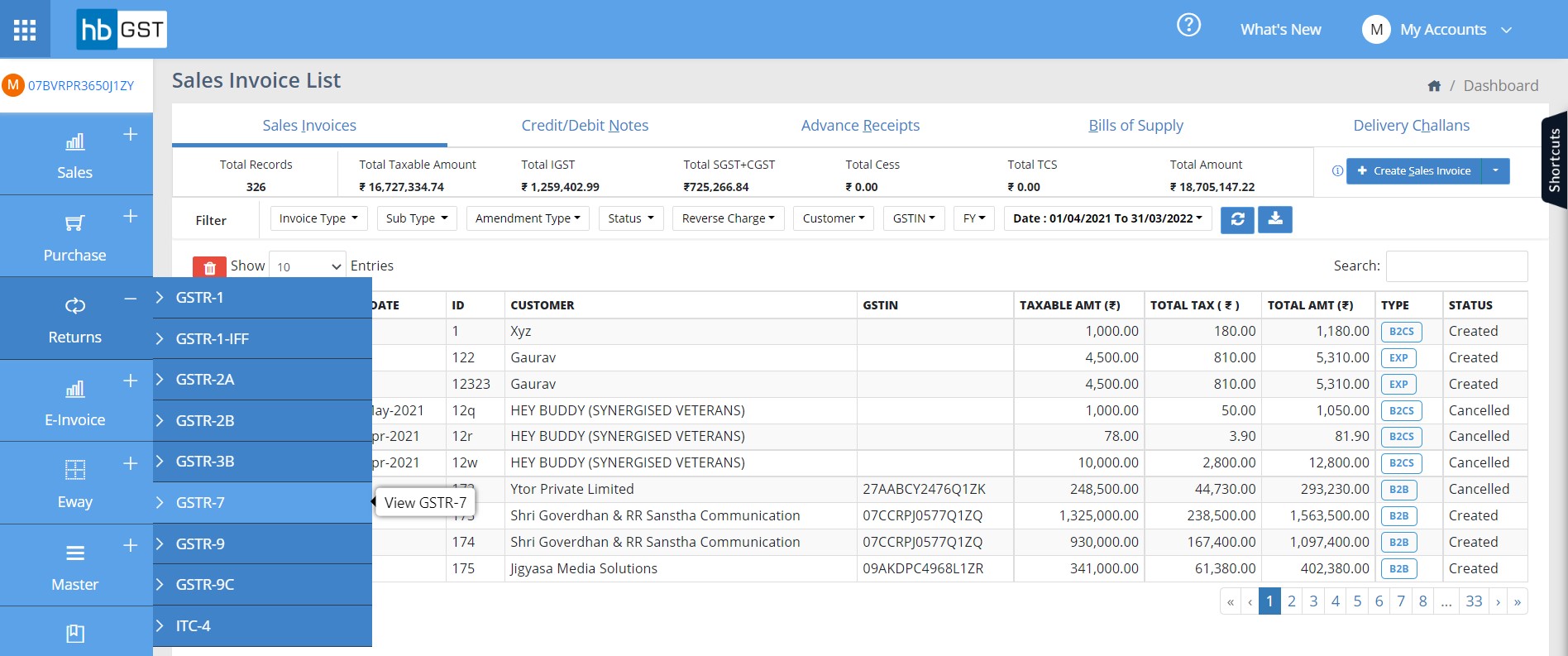

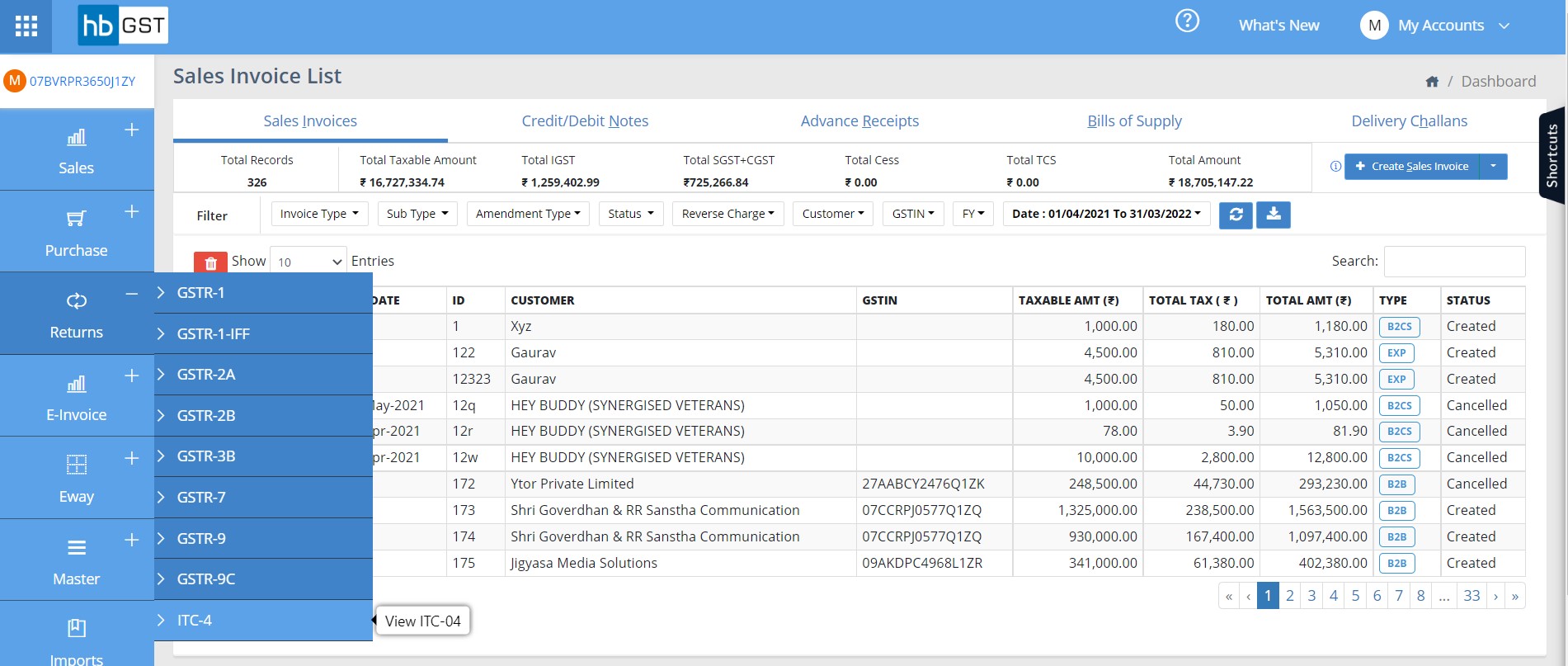

Steps 2: To start filing, click on the Return and click on GSTR-7

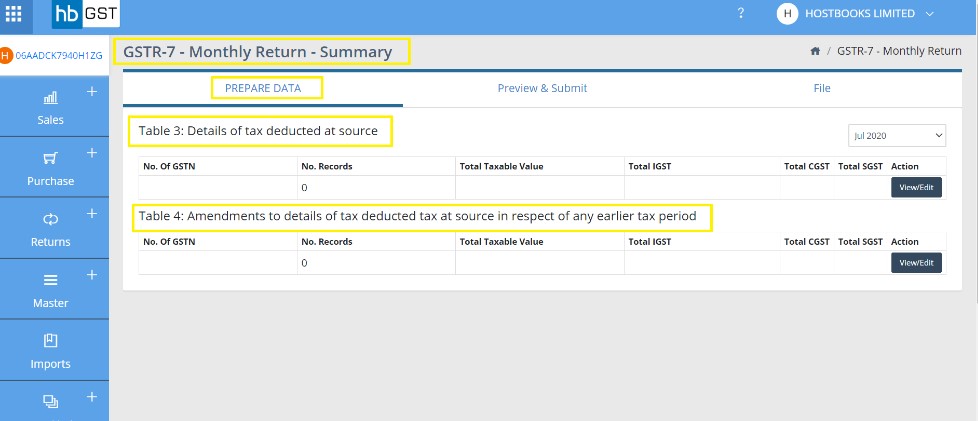

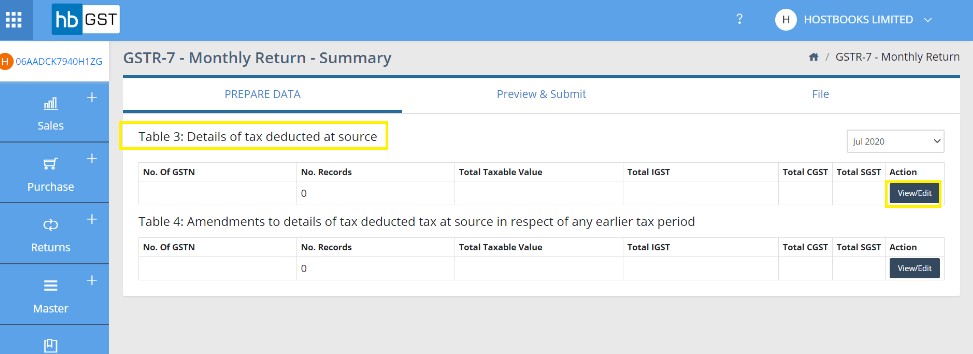

Step3: See the GSTR-7 page.

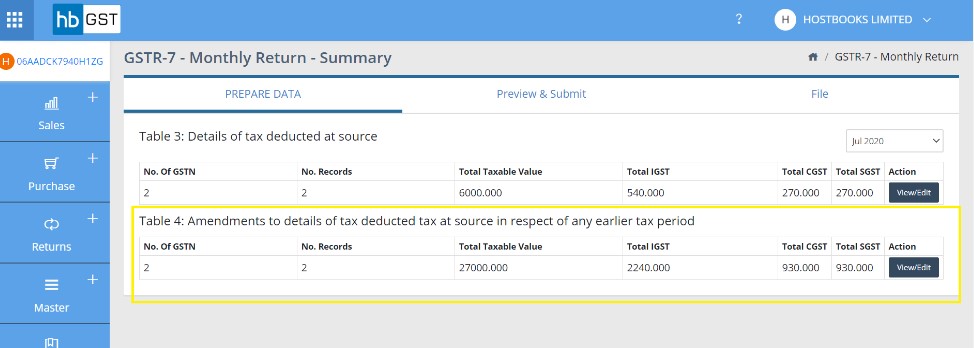

There are 2 table available in GSTR-7

- Table 3: Details of tax deducted at source

- Table 4: Amendments to details of tax deducted tax at source in respect of any earlier tax period.

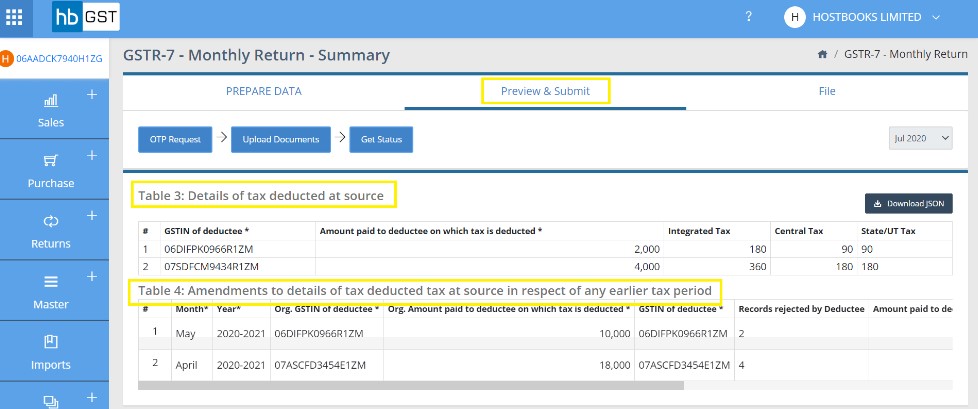

Explanation of Table 3: Details of tax deducted at source

Step 3A: Click on View/Edit button

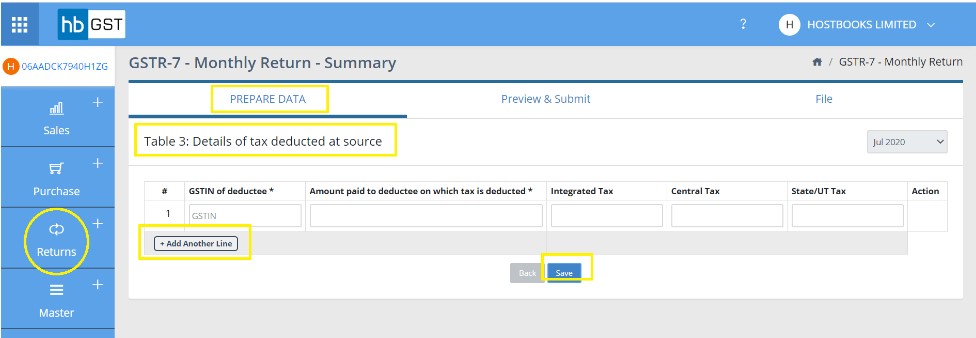

Step 3B: Land on Table-3 data preparation page.

Step 3C: Fill the below details in Page.

- GSTIN of deductee *

- Amount paid to deductee on which tax is deducted *

- Integrated Tax

- Central Tax

- State/UT Tax

- Click on Add Another row for add new line data.

- Click on save.

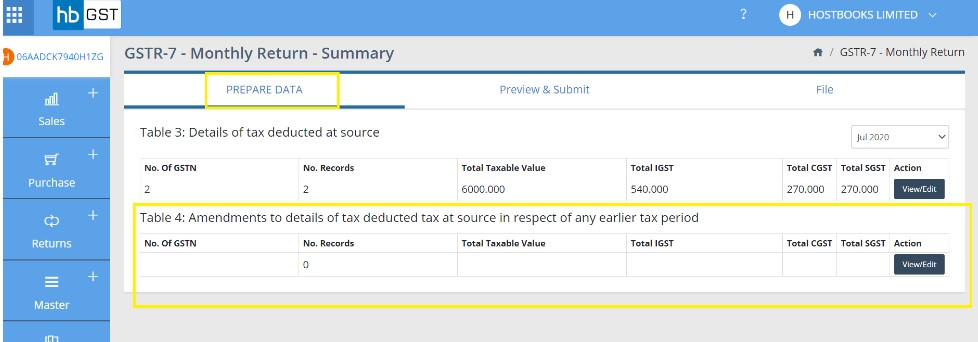

Explanation of Table 4: Amendments to details of tax deducted tax at source in respect of any earlier tax period

Step 4A: Click on View/Edit button

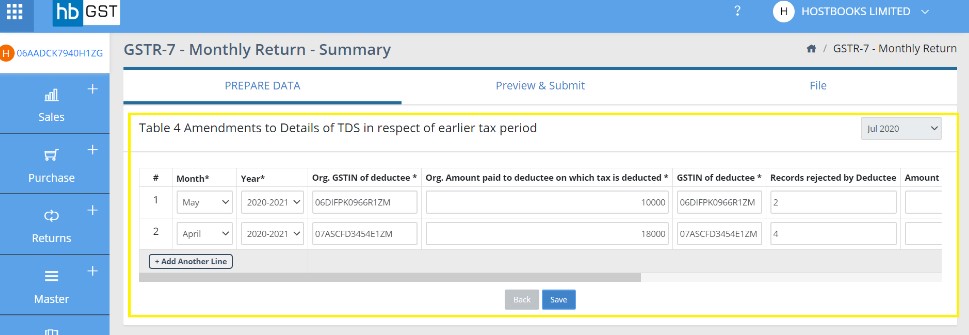

Step 4B: Land on Table-3 data preparation page.

Step 4C: Fill the below details in Page.

- Month*

- Year*

- GSTIN of deductee *

- Amount paid to deductee on which tax is deducted *

- GSTIN of deductee *

- Records rejected by Deductee

- Amount paid to deductee on which tax is deducted *

- Integrated Tax

- Central Tax

- State/UT Tax

- Action Taken

- Action

After data is filled in both tables, following page will open

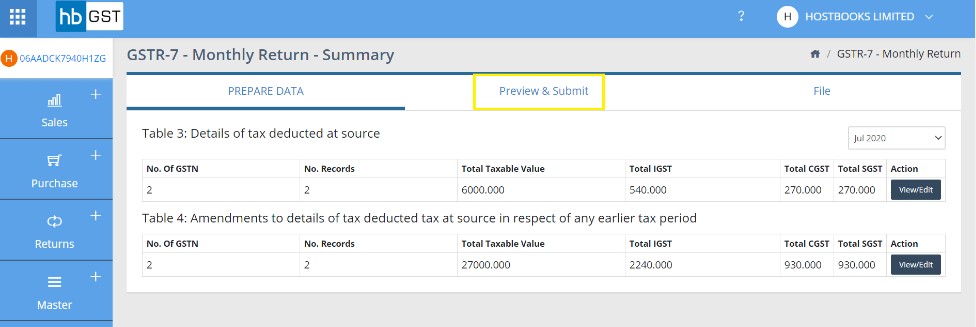

Step 5: Click on Preview and submit.

Step 6: Check the data:

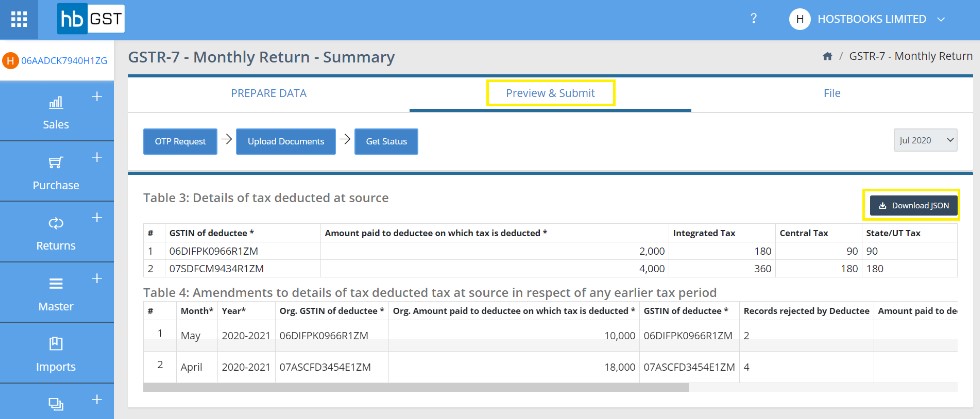

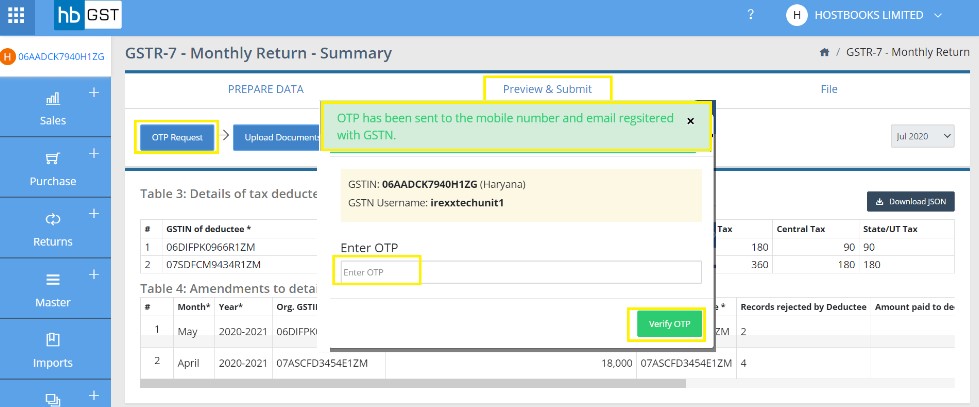

Step 7: Download the JSON file if you want to upload manually to GST Portal otherwise Click on OTP Request.

Step 8: Authorize the details.

Step 9: Enter the OTP and verify.

Step 10: Click on Upload Document.

Step 11: Click on Get Status.

Step 12: Go to the Govt. portal and complete the filling process.

How do I file ITC-4 Returns?

Step 1: Click on the "Transactions" button after entering into the business

Steps 2: To start filing, Click on the Return and click on ITC-4

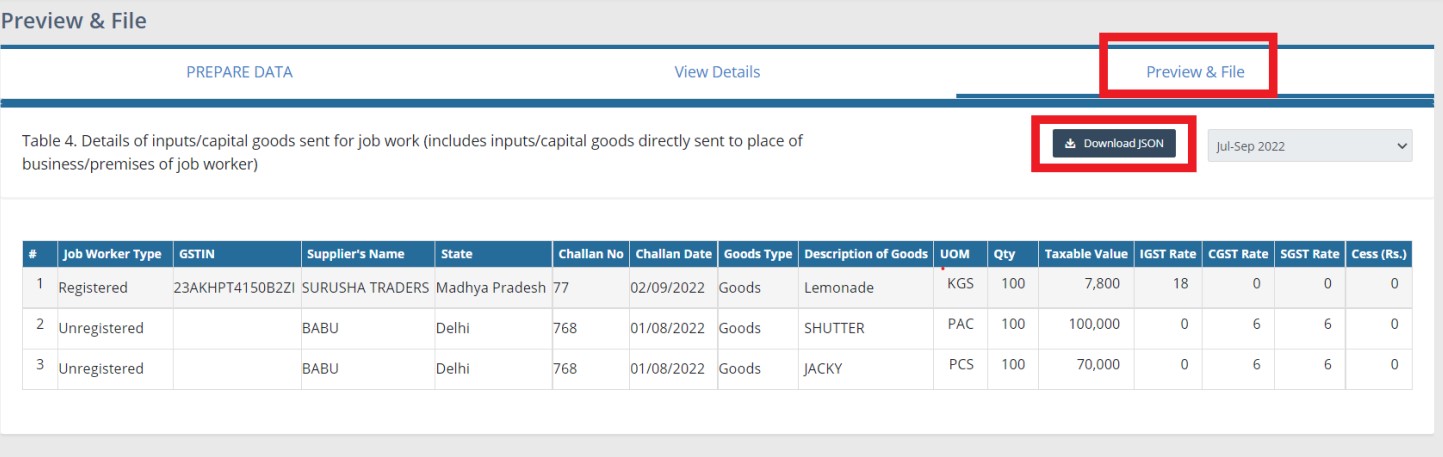

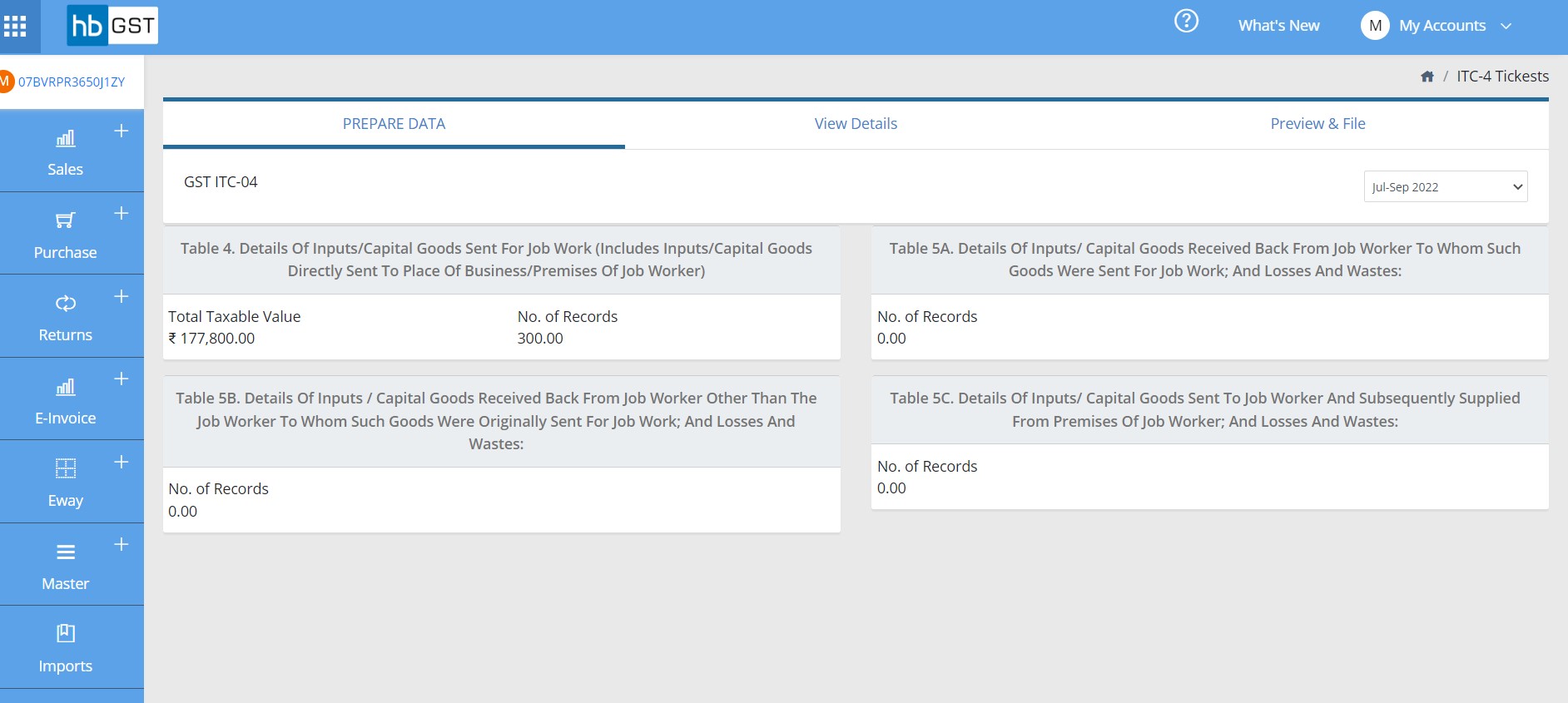

There are 4 tables available in ITC-04

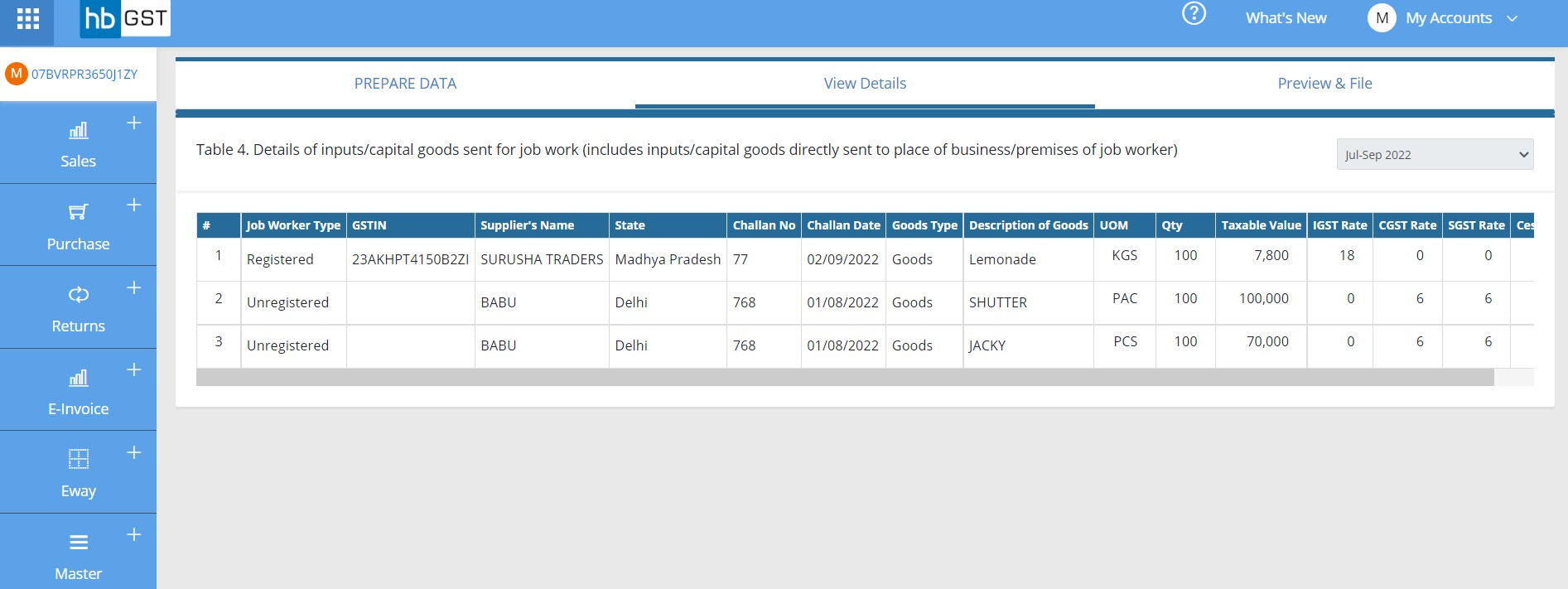

- 1. Table 4. Details of inputs/capital goods sent for job work (includes inputs/capital goods directly sent to place of business/premises of job worker)

- 2. Table 5A. Details of inputs/ capital goods received back from job worker to whom such goods were sent for job work; and losses and wastes

- 3. Table 5B. Details of inputs / capital goods received back from job worker other than the job worker to whom such goods were originally sent for job work; and losses and wastes

- 4. Table 5C. Details of inputs/ Capital goods sent to job worker and subsequently supplied from premises of job worker; and losses and wastes

Software will autofill data in these tables based on the delivery challan transactions saved in the software.

Step 3: Click on each table to check the data

Step 4: View Data page will open

Step 5: Click on Preview & file & then Download the JSON file to upload at GST Portal