How to Create Bill?

How to open Purchase?

Books -> Purchase

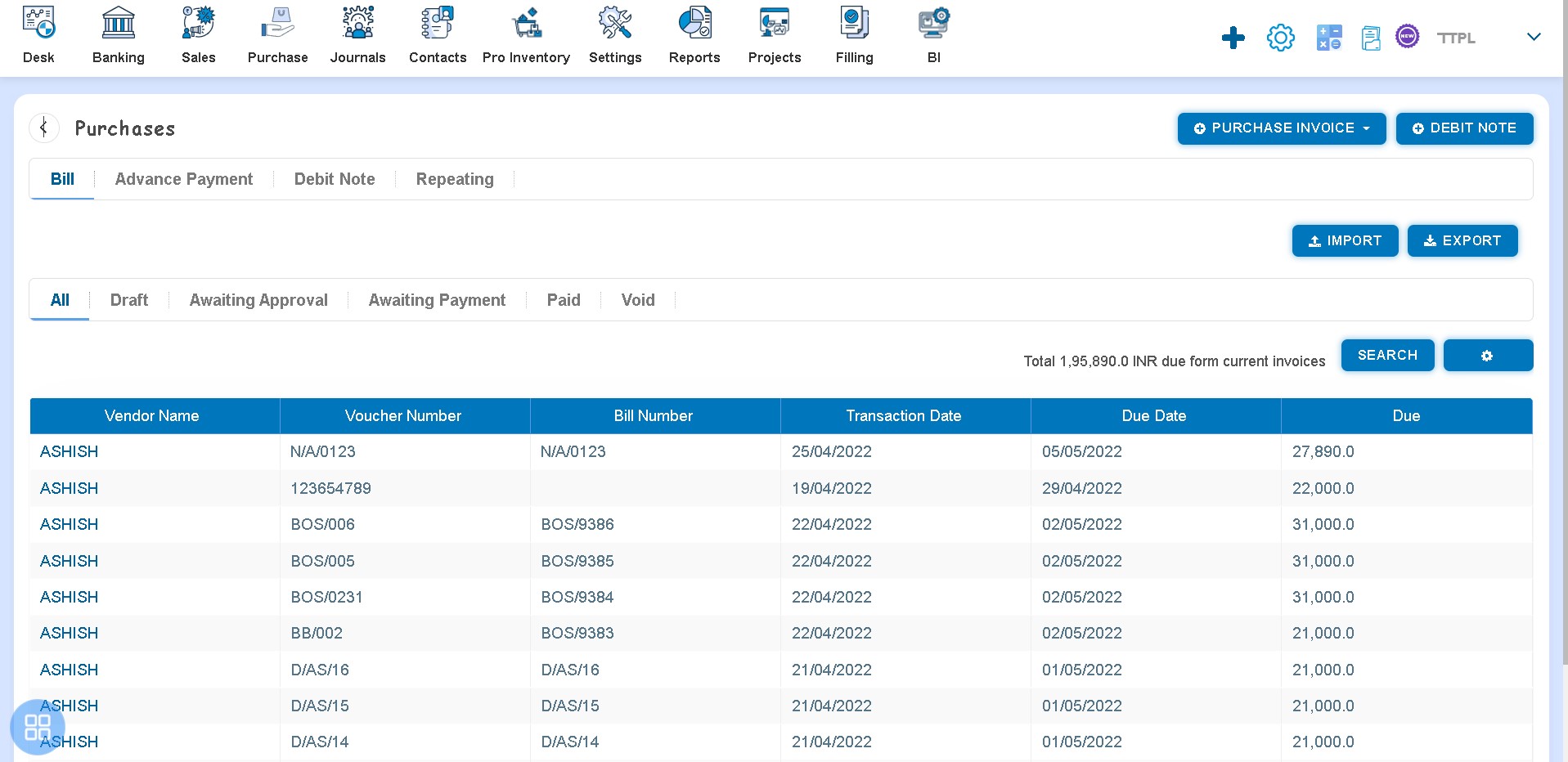

In this page, you will be able to see a list of all Bills that you have already added to the software and you can also create Bill, Repeating Purchase Invoice & Debit Note.

By default after clicking on Purchase, the Bill listing page will appear.

You can also navigate to the other listing pages to view:

- Advance Payment

- Debit Note and

- Repeating Purchase Invoice.

You can view Bills which are:

- Draft

- Awaiting Approval

- Awaiting Payment

- Paid and

- Void

From the listing page you can check the following information about each Bill that has been entered into the software:

- Vendor

- Voucher Number

- Bill Number

- Transaction Date

- Due Date

- Bill Amount

- Paid

- Due

- Status of Bill i.e. Draft, Awaiting Approval, Awaiting Payment etc.

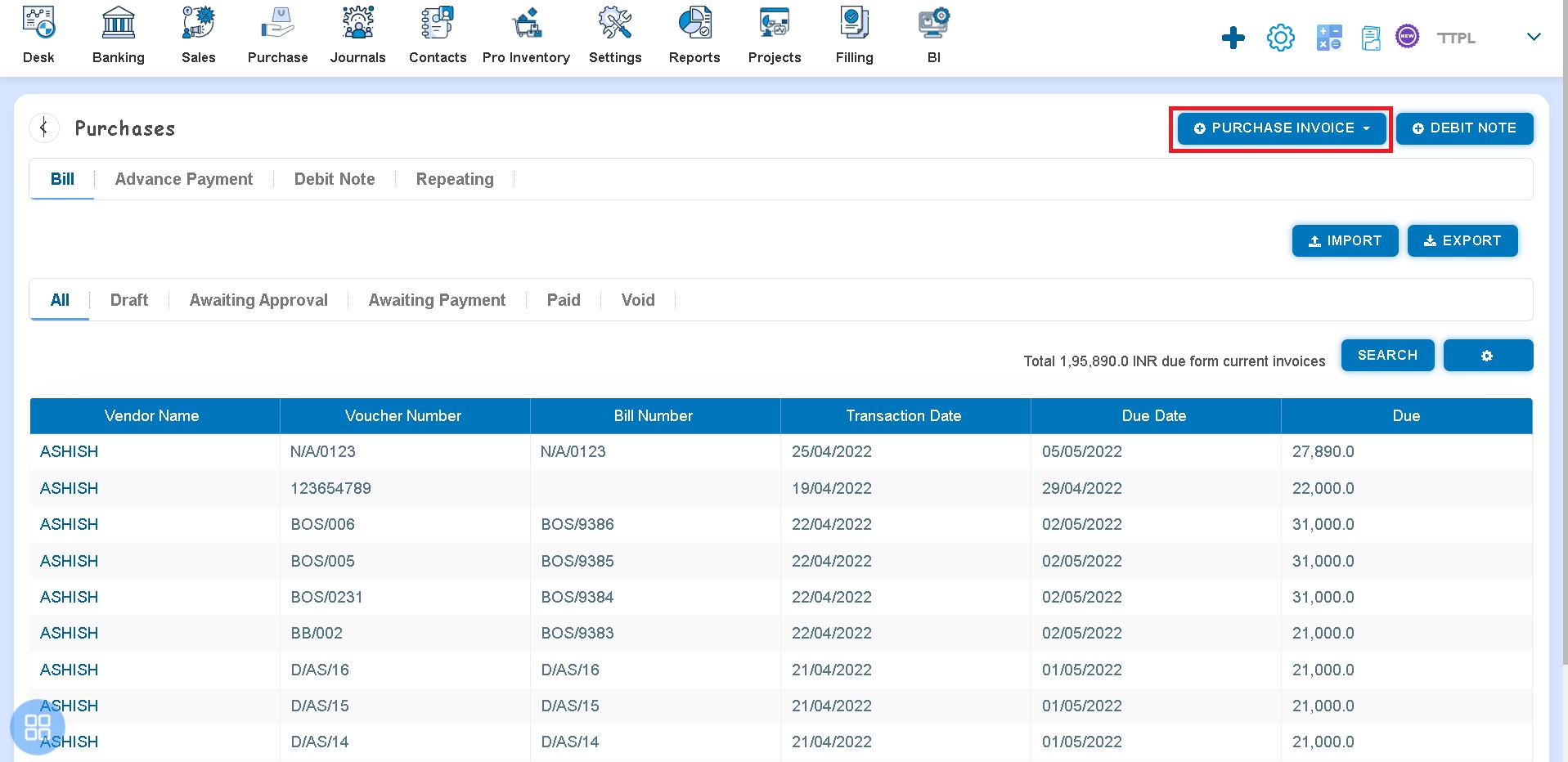

How to Create Bill?

You can create Bill one by one by clicking "+ Purchase Invoice".

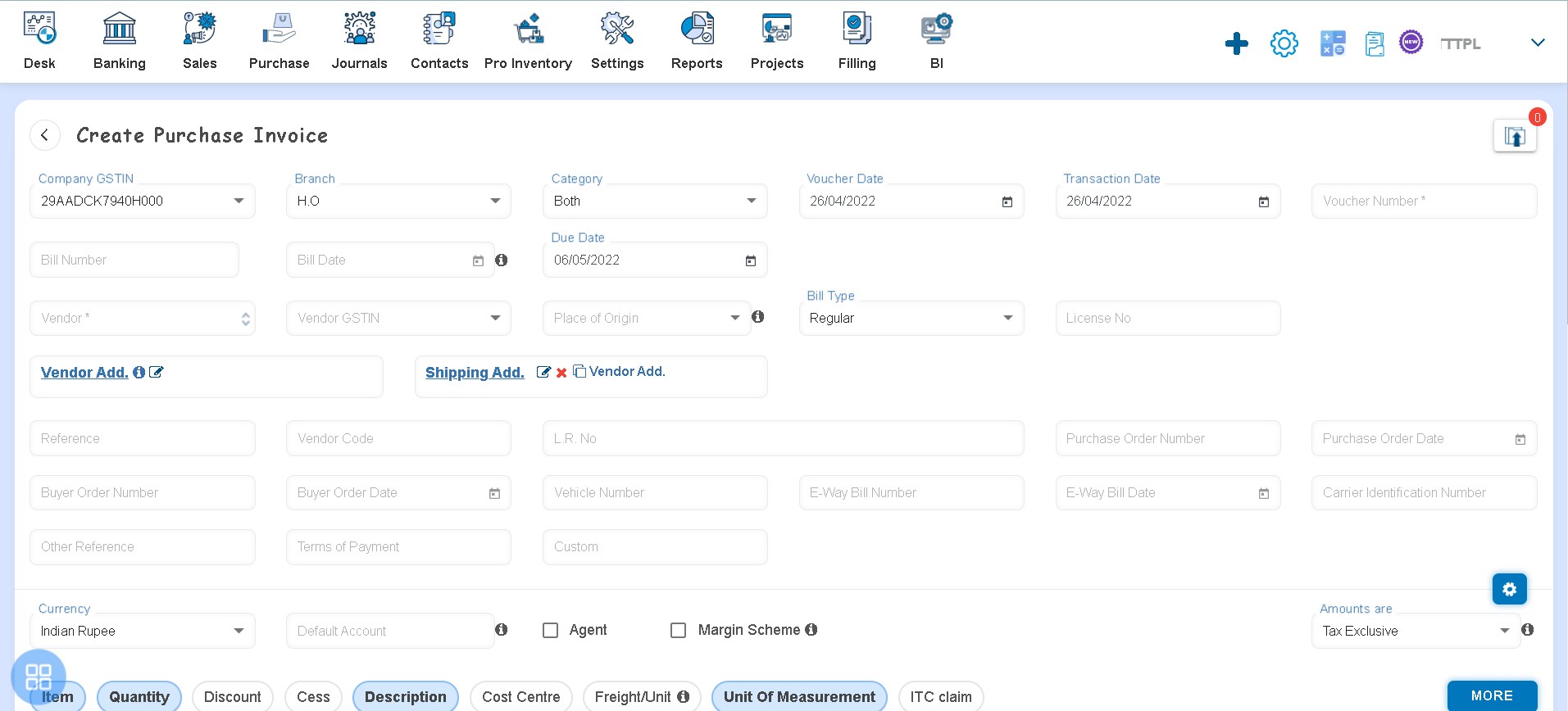

After clicking on "+ Purchase Invoice" - New Purchase Invoice form will be opened.

You are required to fill following fields:-

- Company GSTIN

- Branch

- Category

- Voucher Date

- Transaction Date

- Voucher Number

- Bill Number

- Bill Date

- Due Date

- Vendor

- Vendor GSTIN

- Place of Origin

- Bill Type

- License No.

- Vendor Address

- Shipping Address

- Reference

- Vendor Code

- L.R. No.

- PO Number

- PO Date

- Buyer Order Number

- Buyer Order Date

- Vehicle Number

- E-Way Bill Number

- E-Way Bill Date

- Carrier Identification Number

- Other Reference

- Terms of Payment

- Custom fields

- Currency

- Default Account

- Agent

- Amounts are

Fill the Item Details such as:-

- Item

- Description

- Item Code

- Batch Number

- Expiry Date

- Item Type

- HSN/SAC

- Unit of Conversion

- Quantity

- Quantity Allocate

- Conversion UOM

- Equivalent Qty

- Unit of Measurement

- MRP

- Unit Price/Rate

- Discount (%, Flat)

- PTR/Unit

- Add. Discount (%, Flat)

- PTS/Unit

- Subsidy (%, Flat)

- Freight/Unit

- Delivery/Unit

- Account

- Cost Center

- Taxable Value

- Tax Rate

- Tax Amount

- Item Custom fields

- GST Rate

- IGST

- CGST

- SGST/UGST

- Cess (%, Flat)

- Add. Cess

- NIL/Exempt Rate

- TDS Rate

- TDS Amount

- ITC Eligibility

- ITC Claim (%)

- ITC Claim IGST

- ITC Claim CGST

- ITC Claim SGST/UGST

- ITC Claim Cess

- Total

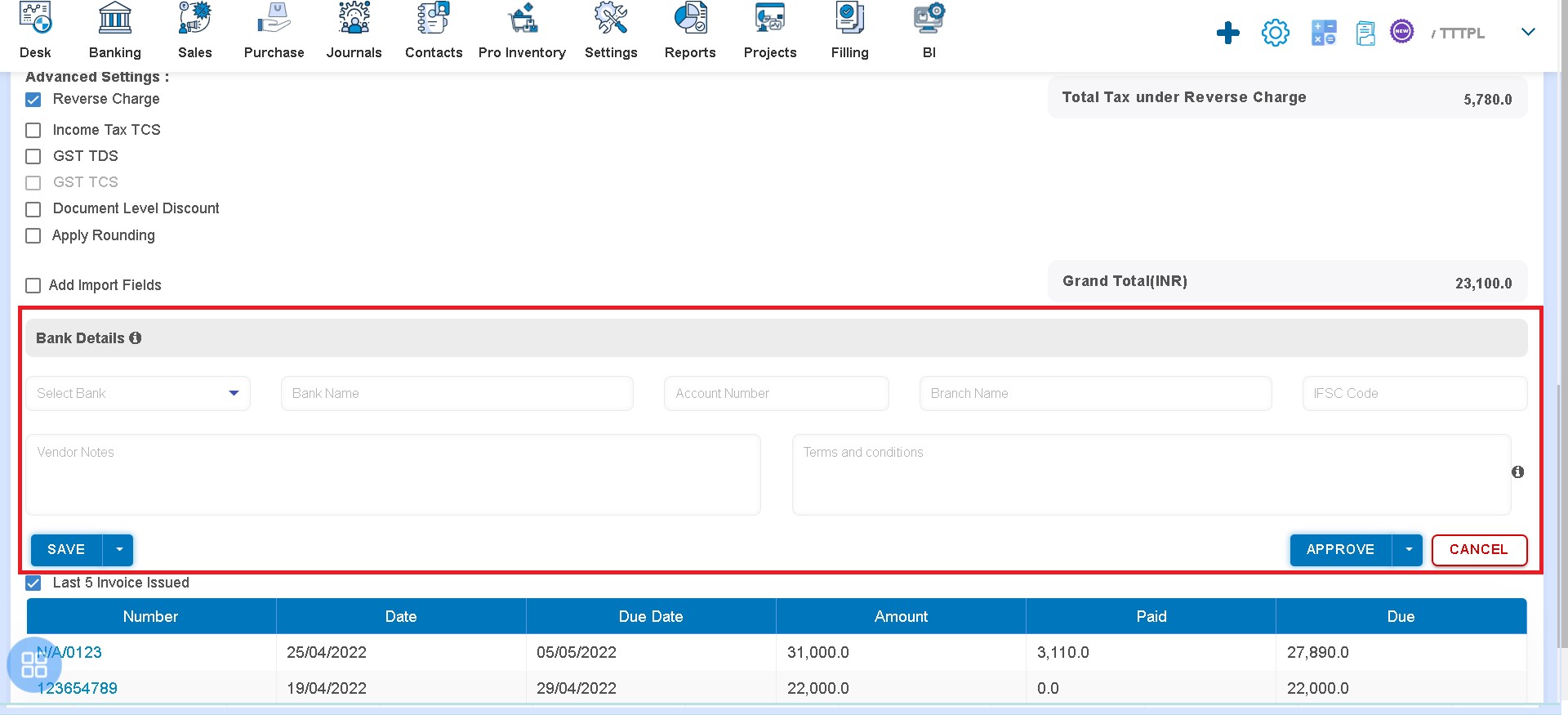

Fill Bank Details such as:-

- Bank Name

- Account Number

- Branch Name

- IFSC Code

What Mandatory fields are required?

For creating the Bill you are required to fill some mandatory fields such as:-

- Vendor

- Voucher Date

- Transaction Date

- Voucher Number

- Due Date

- Vendor Address

- Place of Origin

- Quantity

- Unit Price

- Account

- GST Rate (Mandatory if Amount Are Tax Exclusive or Tax Inclusive)

How to set Auto-fields?

You can set some auto-fill functionalities for creating the Bill. Such Auto-Fields are:-

- Voucher date: By default current date will be the Voucher Date. You can also change the same.

- Transaction Date: By default current date will be the Transaction Date. You can also change the same.

- Due Date:By default Bill due date is also given by the software. However, you can change the same.

- Branch (Auto): You are required to Add Branch in Organization Settings. Those added Branch lists will appear at the time of the creation of Bill.

For adding Branch - Navigate to Settings -> Organization Settings -> Location -> Add Branch.

- Category (Auto): You are required to Add a Category in Organization Settings. Those added Category lists will appear at the time of the creation of Bill.

For adding Category - Navigate to Settings -> Organization Settings -> Location -> Add Category.

- Bill Number (Auto): Bill Number will auto-populate from series as set by you in Custom Configuration. However, you can change the same.

For Setting series - Navigate to Settings -> Custom Configuration -> Document Series -> Select Purchase Invoice.

How to Hide/Unhide fields?

You can Hide/Unhide some fields from the Document Customization. By default, fields are unchecked in Document Customization. You can check those fields which you want to show in Bill.

Navigate to Settings -> Custom Configuration -> Document Customization -> Select Purchase Invoice.

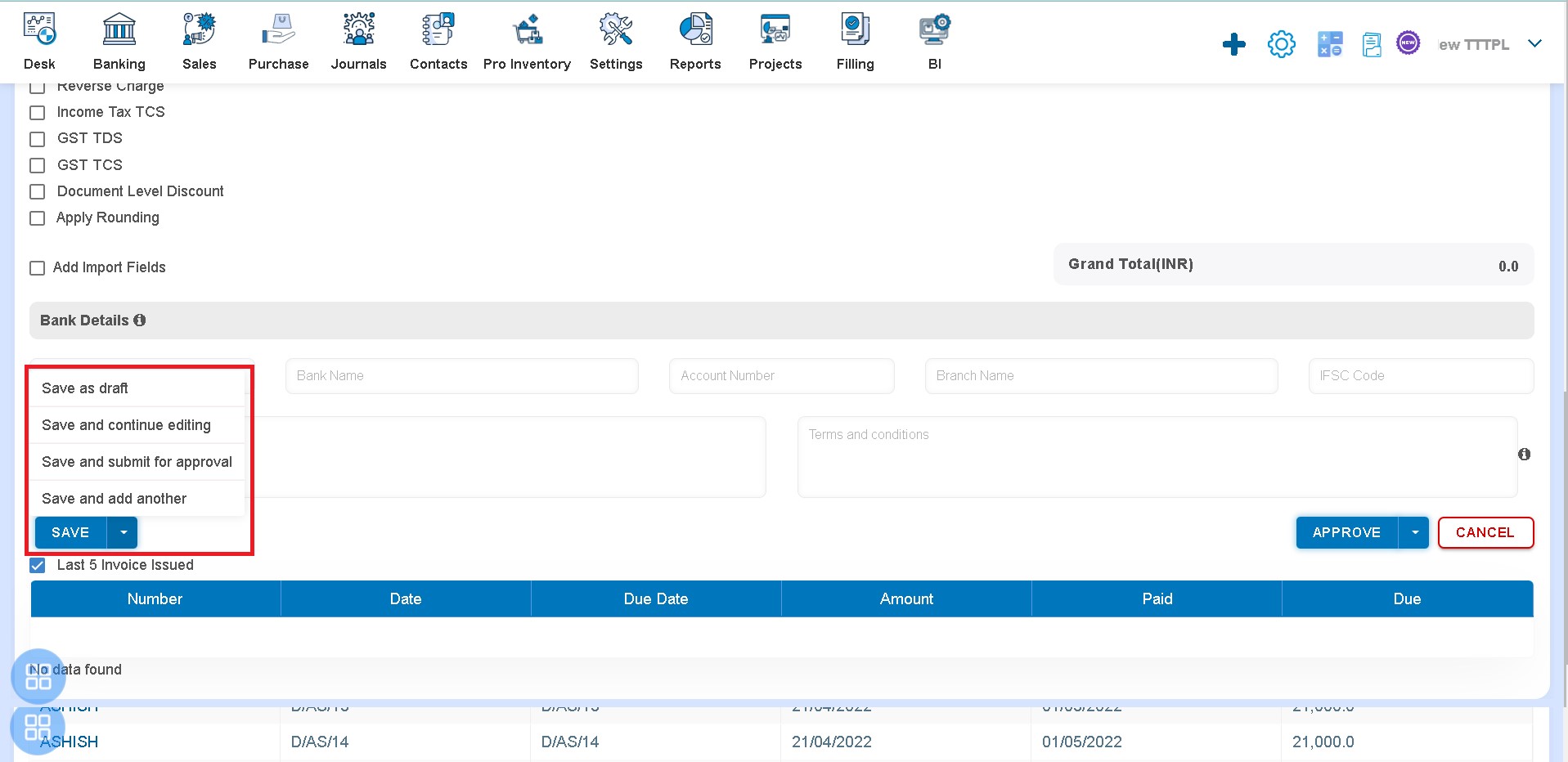

How to Save Bill?

You can save the Bill into the following three types:

- Save as Draft

- Save and Submit for Approval

- Save as Approve

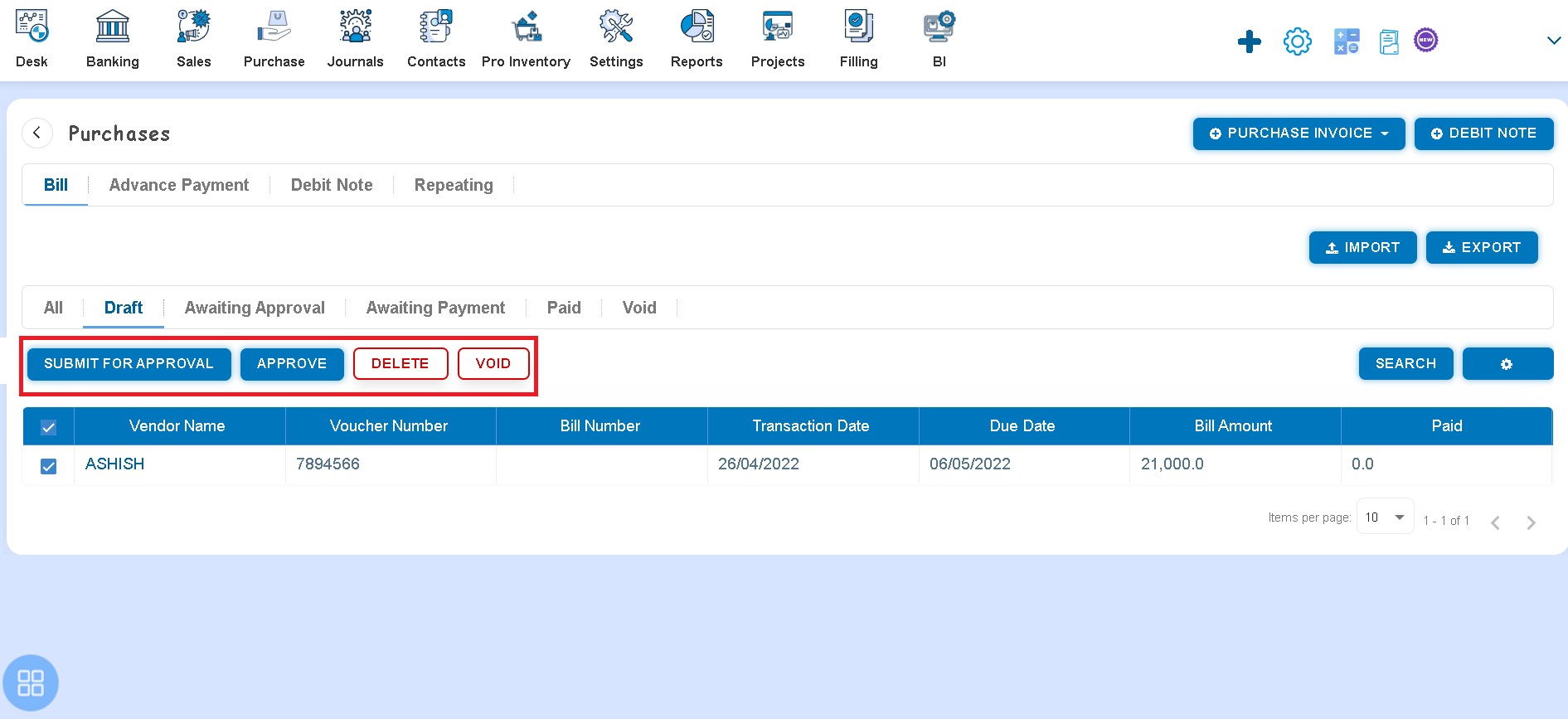

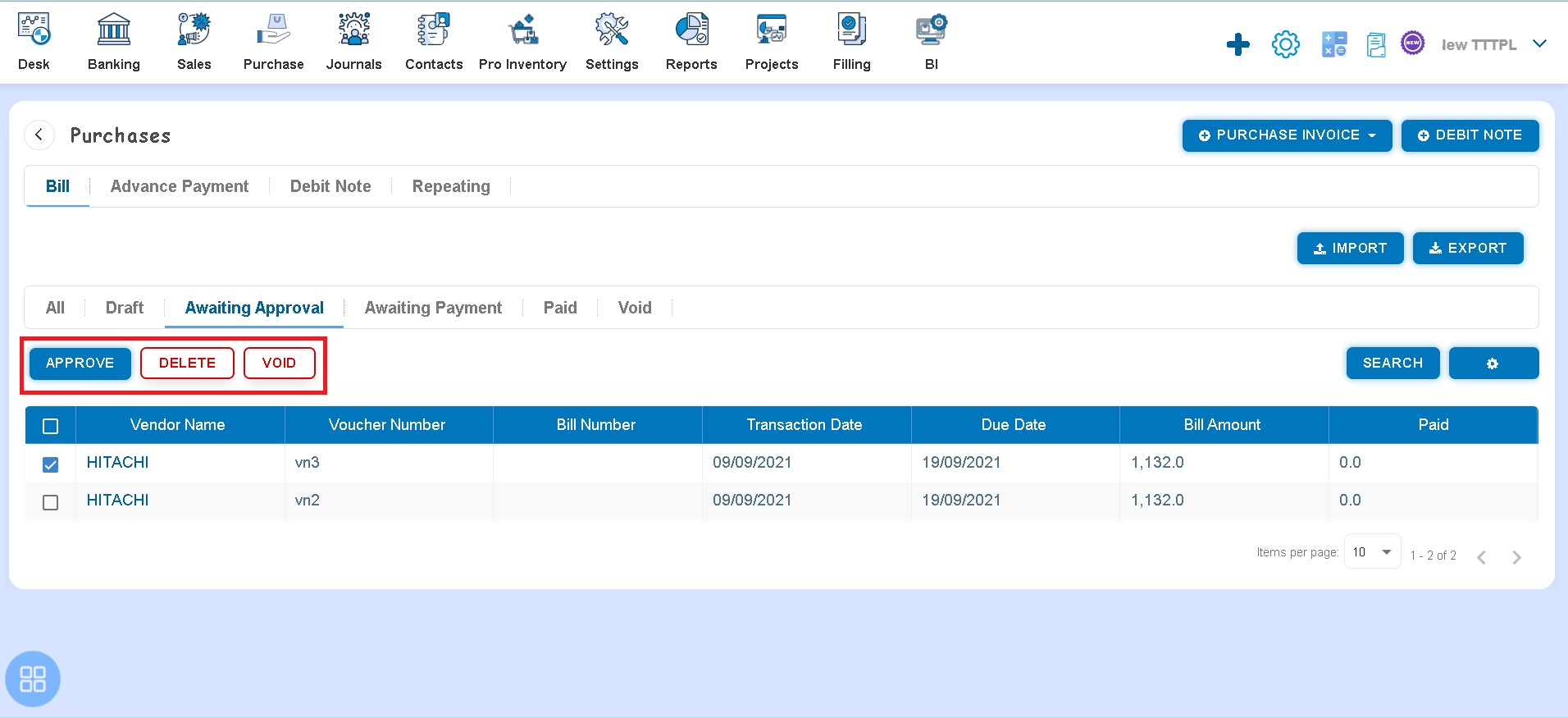

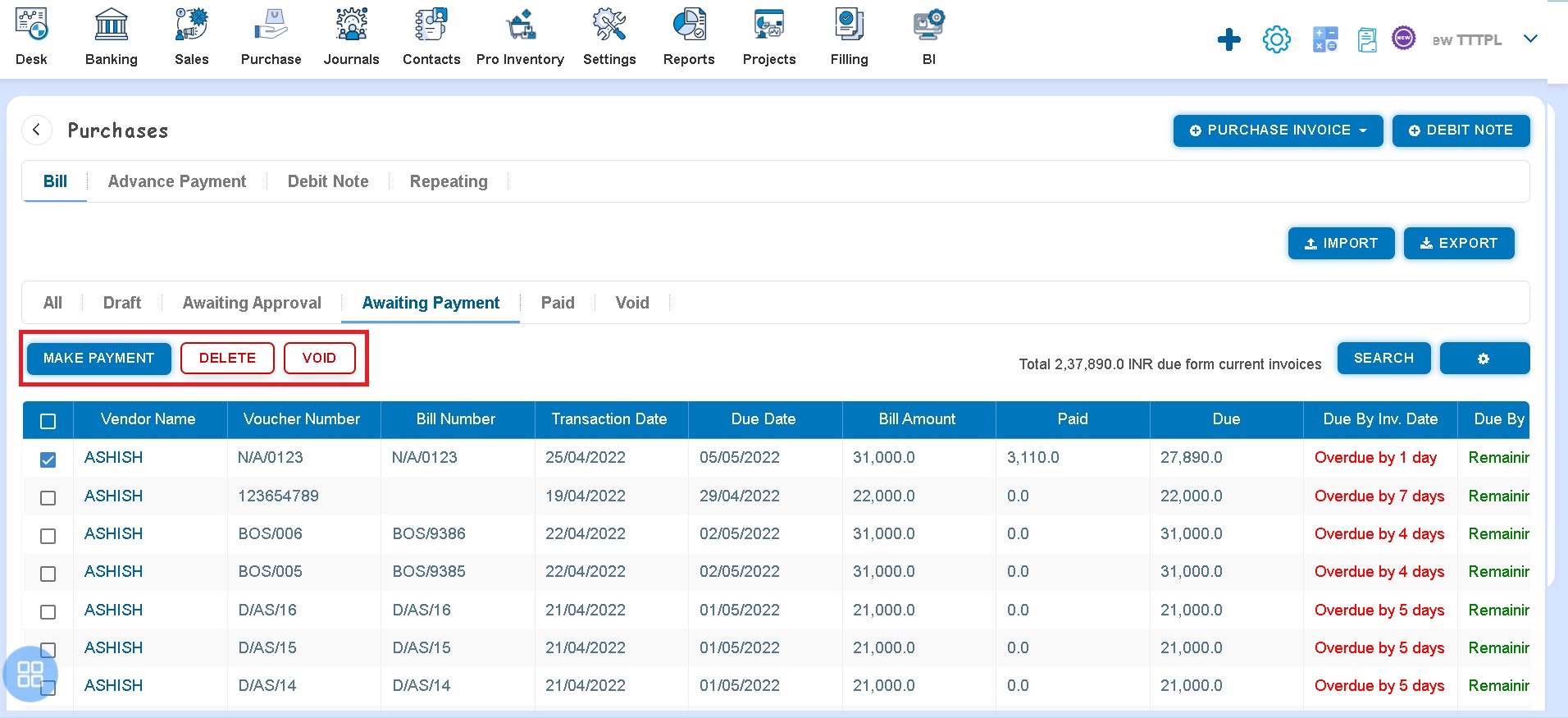

How to change the status of Bill from Listing?

- Navigate to Draft listing from All Bill listing and select the Bill which you want to move in "Submit for Approval", "Approve", "Void", and "Delete".

- Navigate to Awaiting Approval listing from All Bill listing and select the Bill which you want to move in "Approve", "Void" and "Delete".

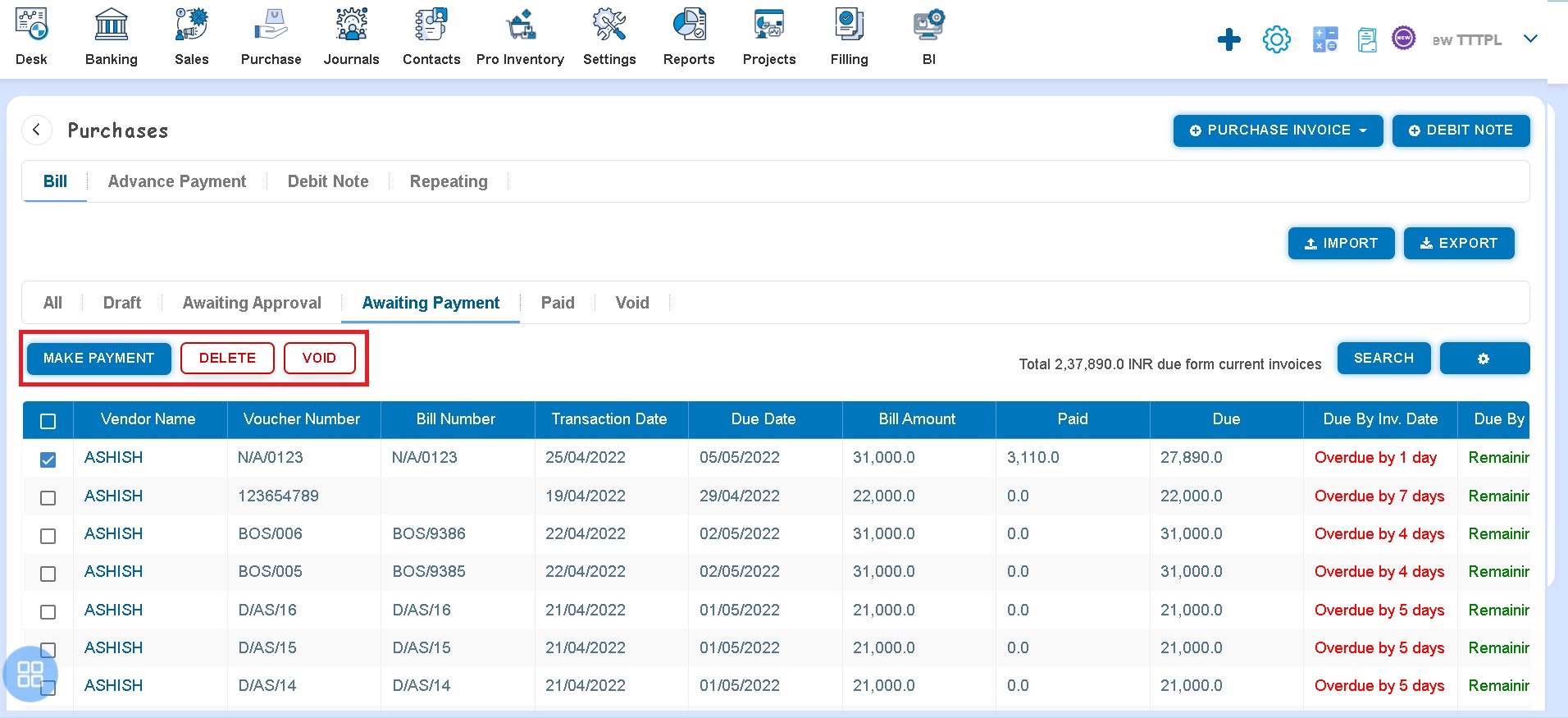

- Navigate to Awaiting Payment listing from All Bill listing and select the Bill which you want to move in "Make Payment", "Void" and "Delete".

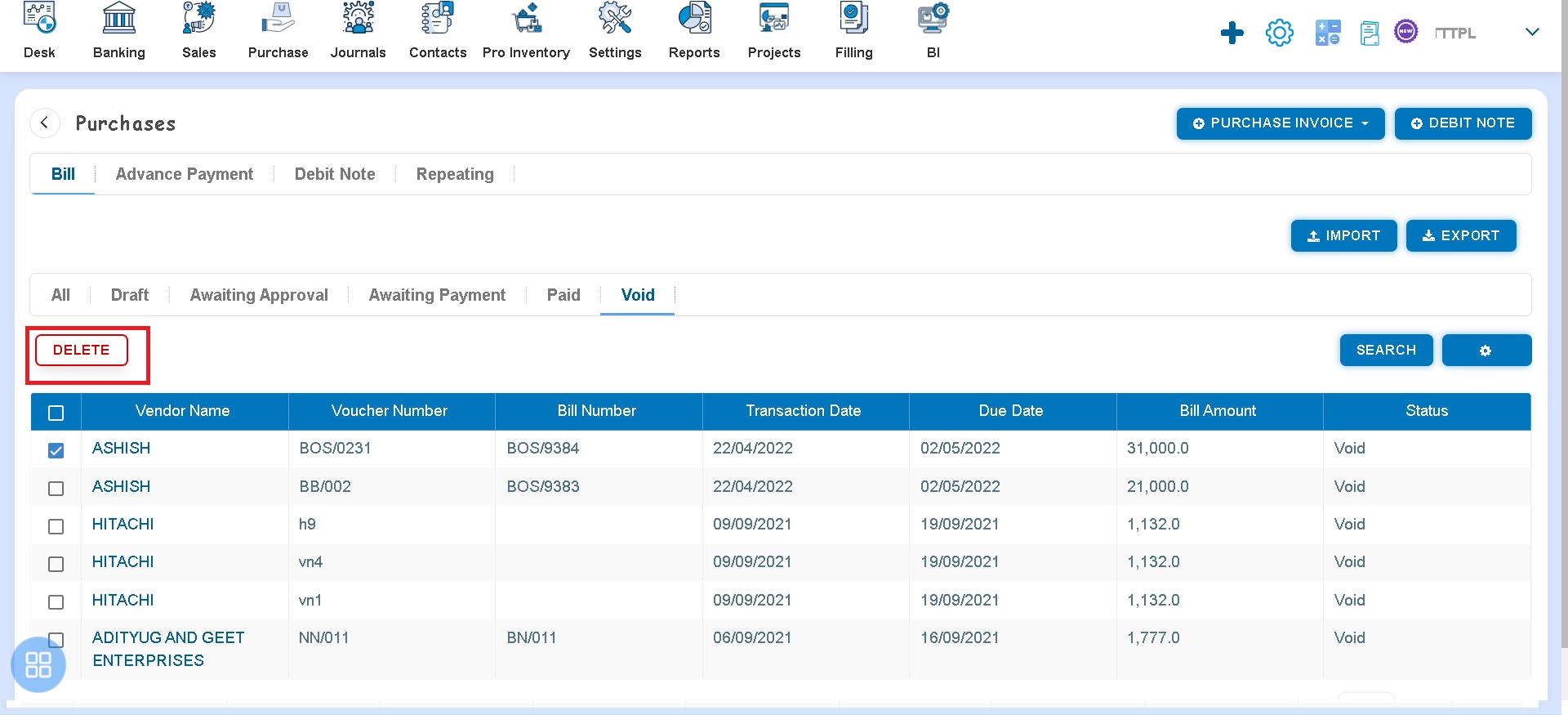

- Navigate to Void listing from All Bill listing and select the Bill which you want to "Delete".

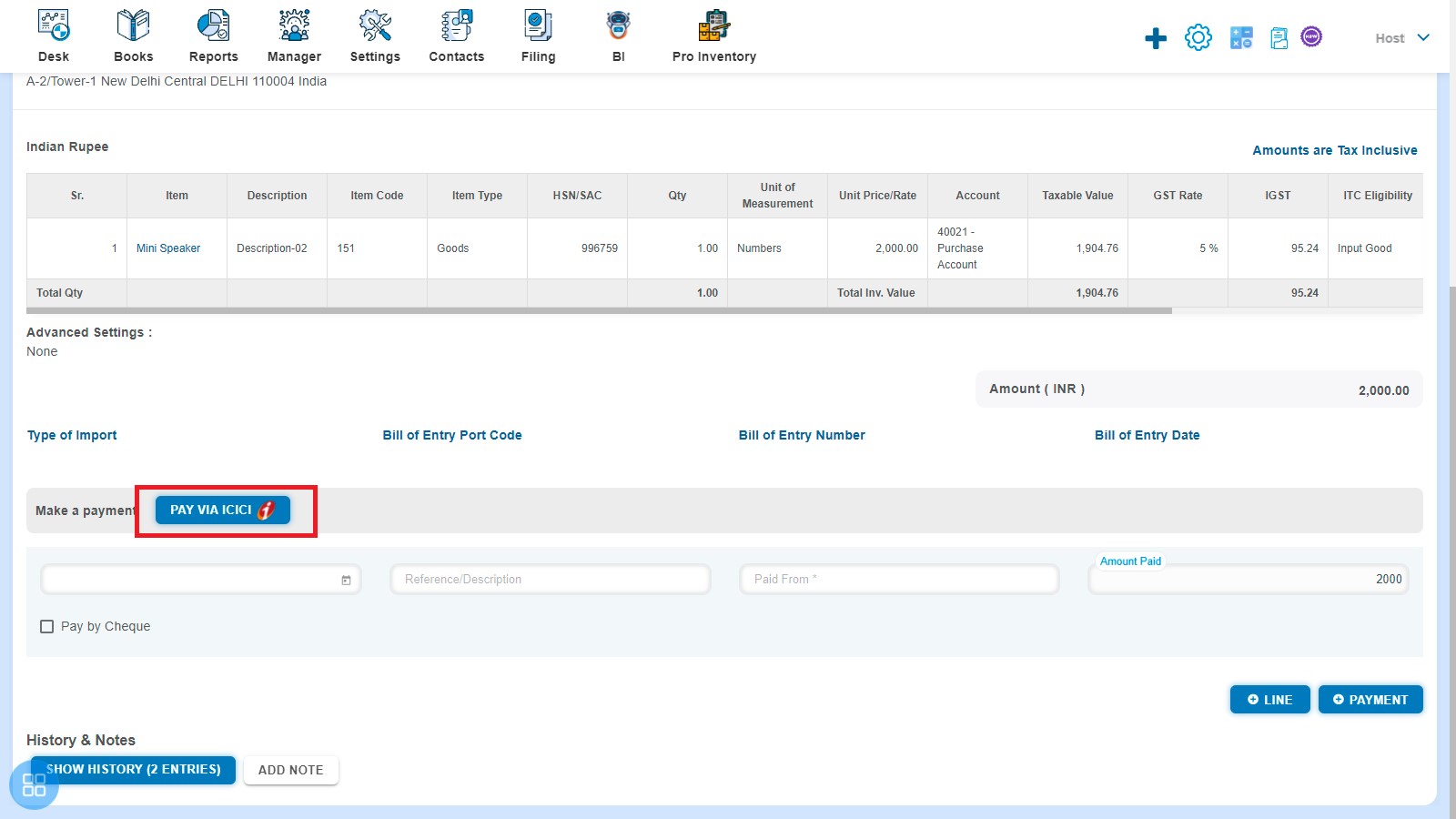

How to make payment of Bill?

There are three ways to make payment.

- Create a Bill and click on Approve button then it will navigate to Bill Listing Page. In the Bill listing page, open the Bill for which status is Awaiting Payment in View Mode. Enter the following fields and click on + Payment:

- Amount Paid

- Date Paid

- Paid From

- Reference

- Pay by Cheque

- Navigate to Awaiting Payment listing page from All Bill listing and select the single or multiple Bill against which are you want to "Make Payment"

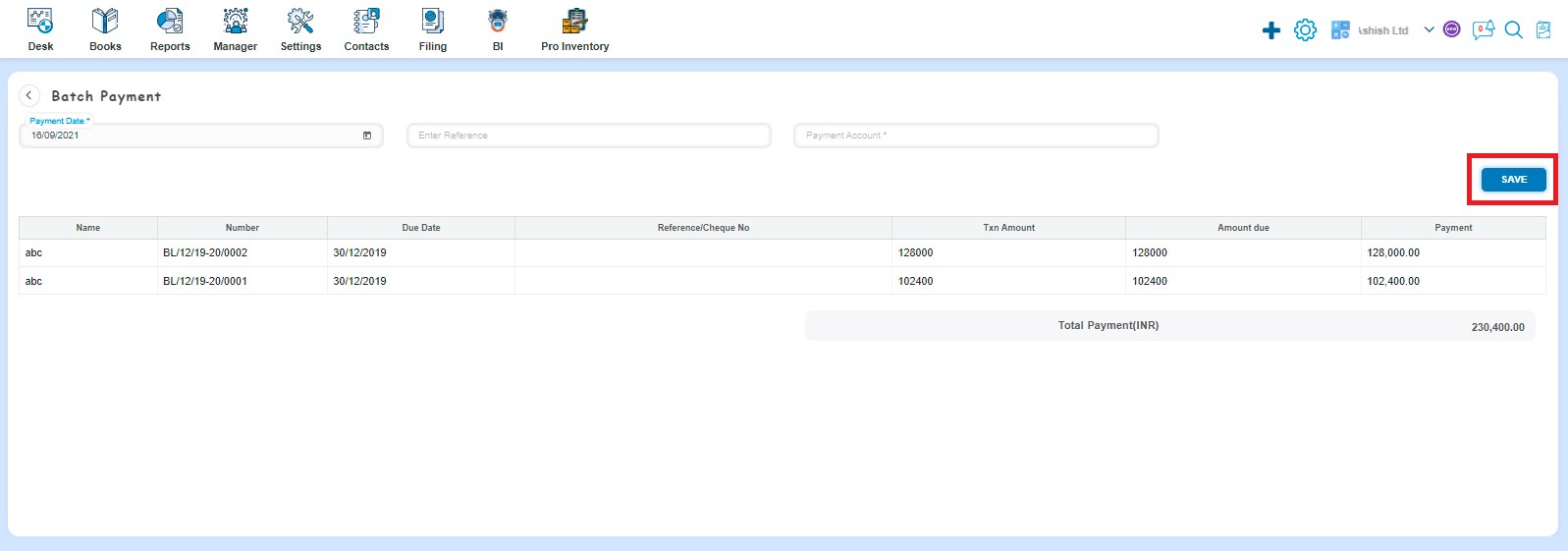

Click on Make Payment then it will redirect to Batch Payment. Enter following fields and click on Save.

- Payment Date

- Reference

- Payment Account

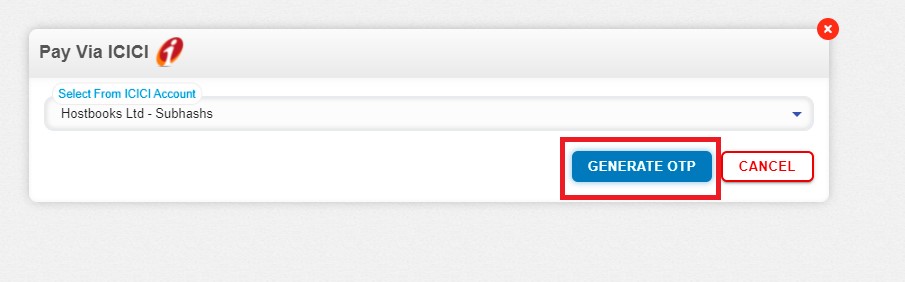

- Create a Bill and click on Approve button then it will navigate to Bill Listing Page. In the Bill listing page, open the Bill for which status is Awaiting Payment in View Mode. Click on Pay VIA ICICI

Click on Pay VIA Payment then it will redirect to pop of Payment VIA Payment. Select ICICI Account and click on Generate OTP.

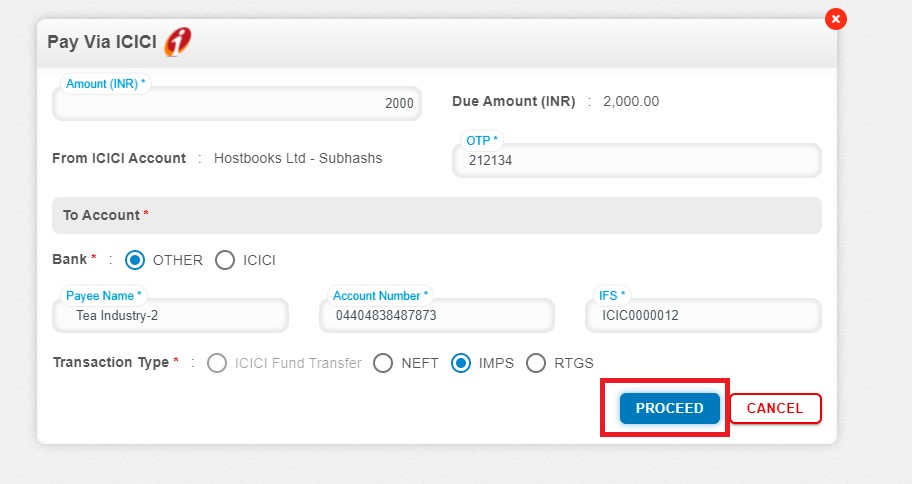

It will redirect to pop Pay VIA ICICI. Enter following fields and click on Proceed

- OTP

- Account Number

- IFSC

- Transaction Type

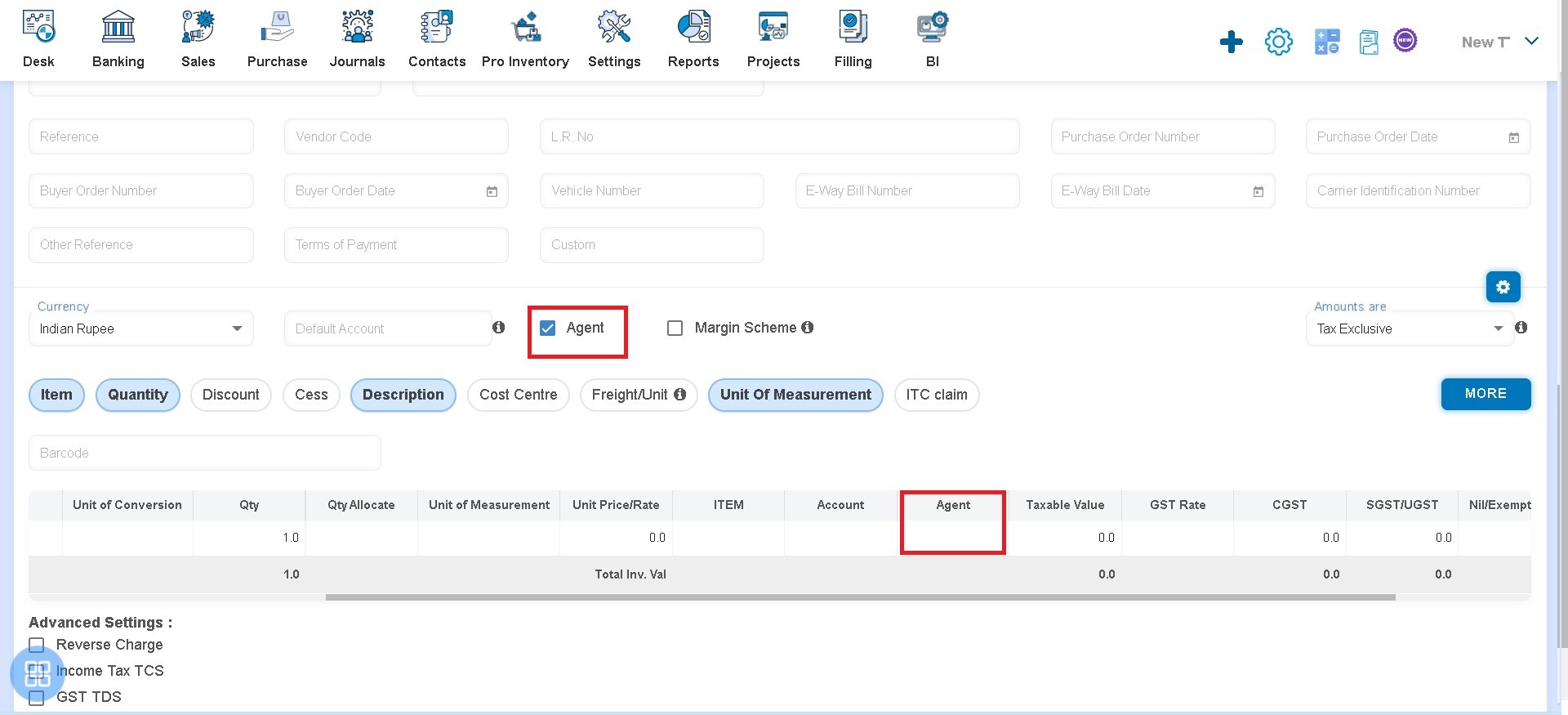

How to add an Agent?

Create a Bill and select the Agent check box then the Agent column is enabled in the Item table. You can select the Agent from the drop-down list.

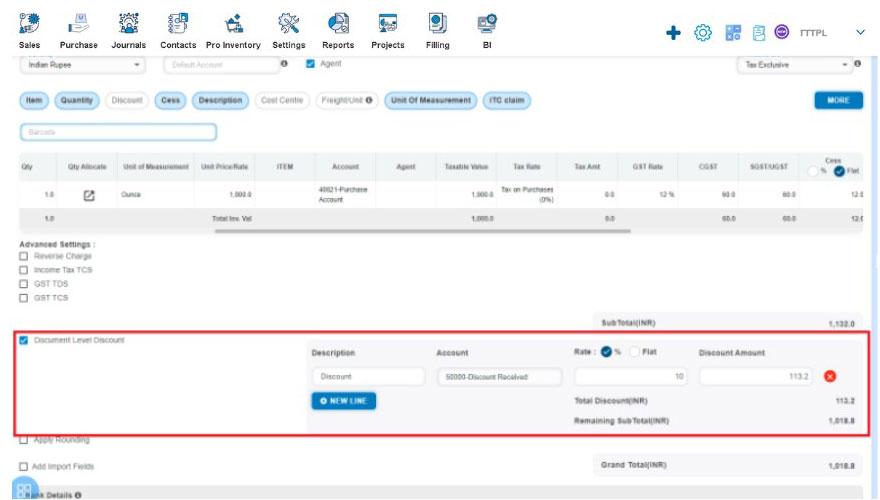

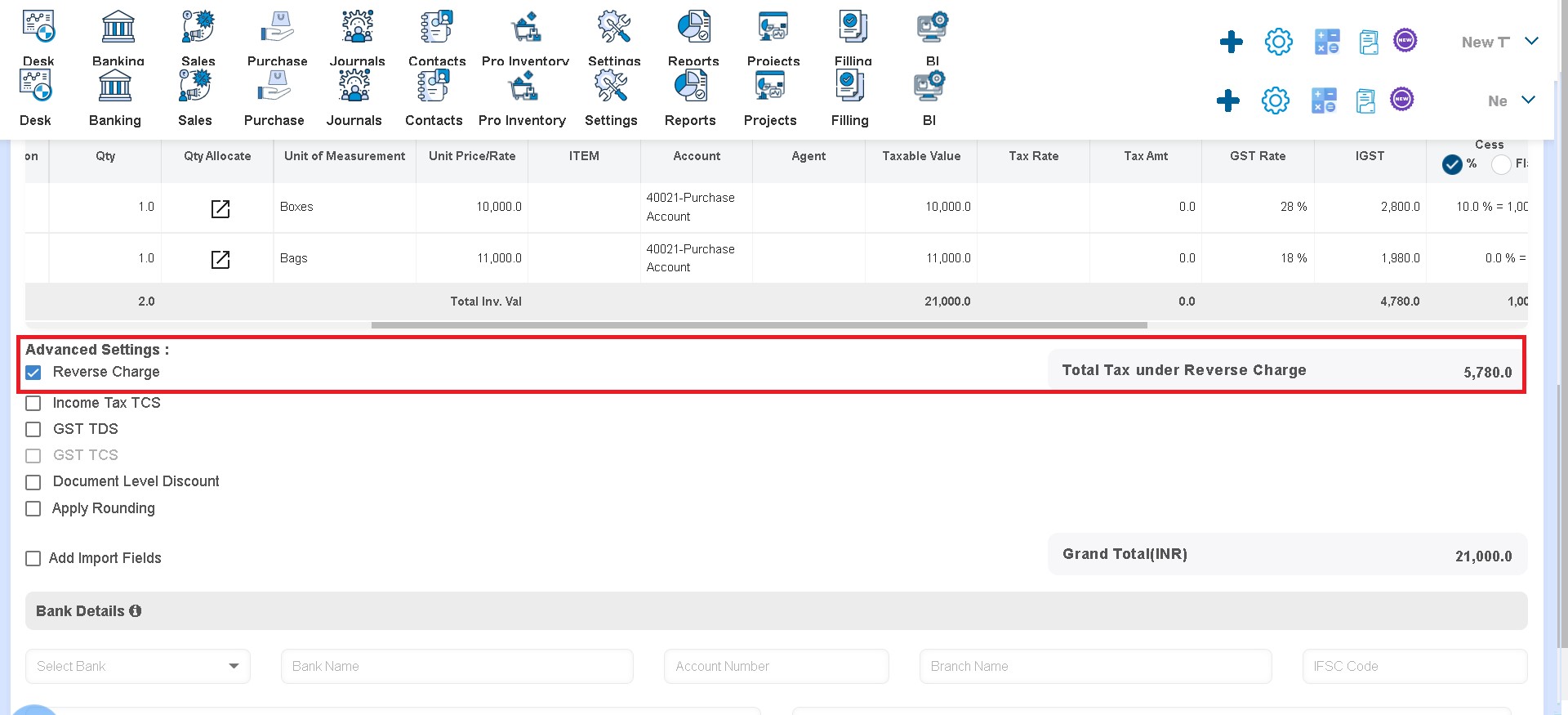

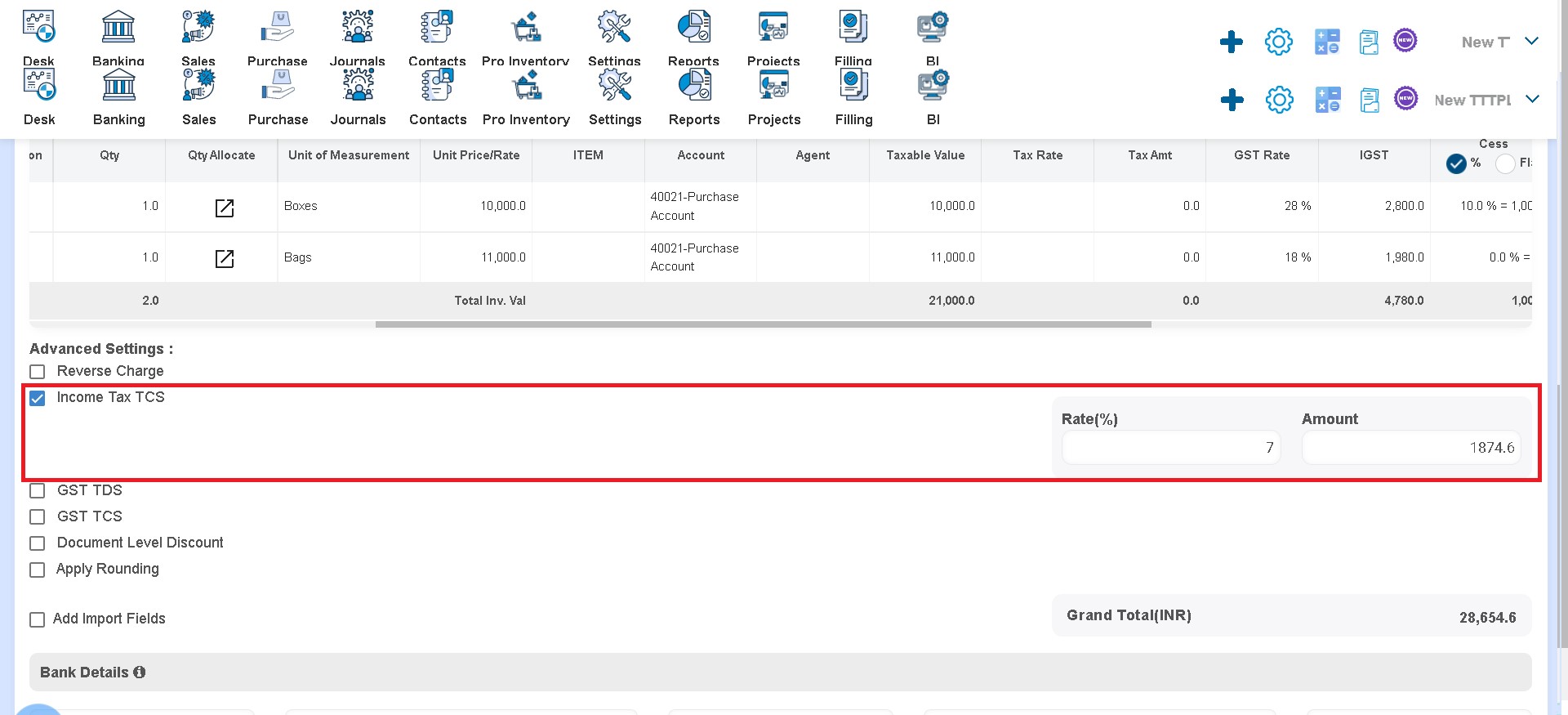

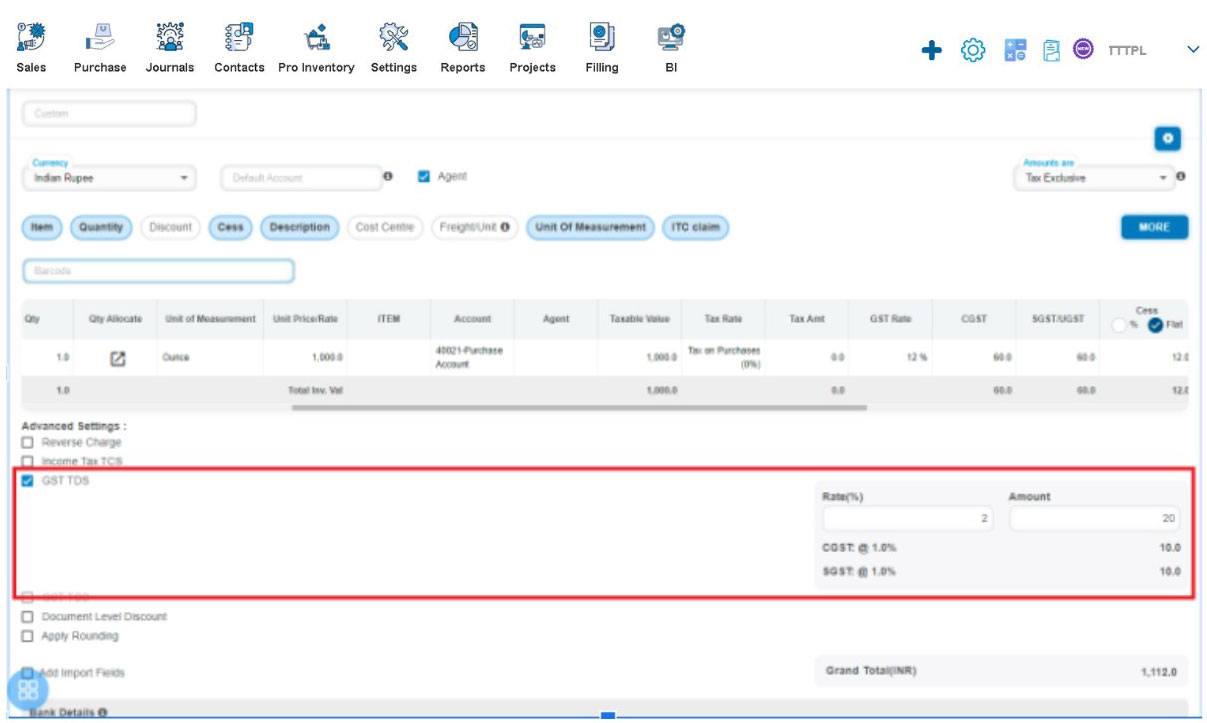

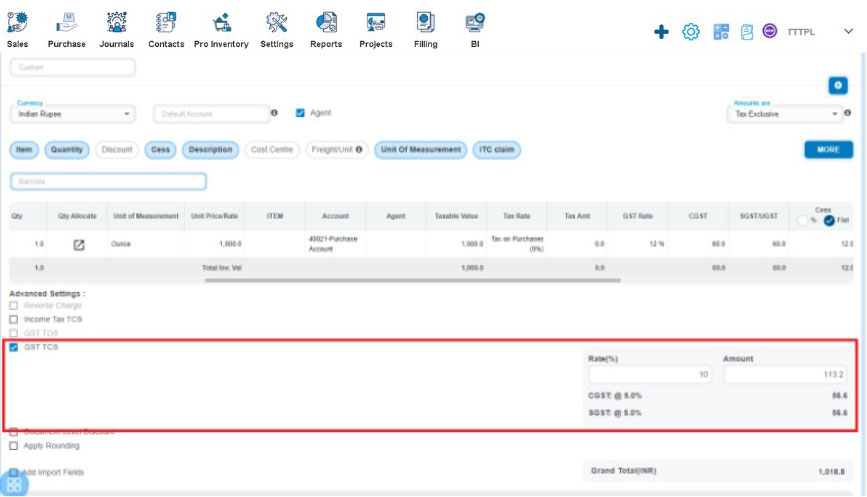

How to manage Advanced Settings?

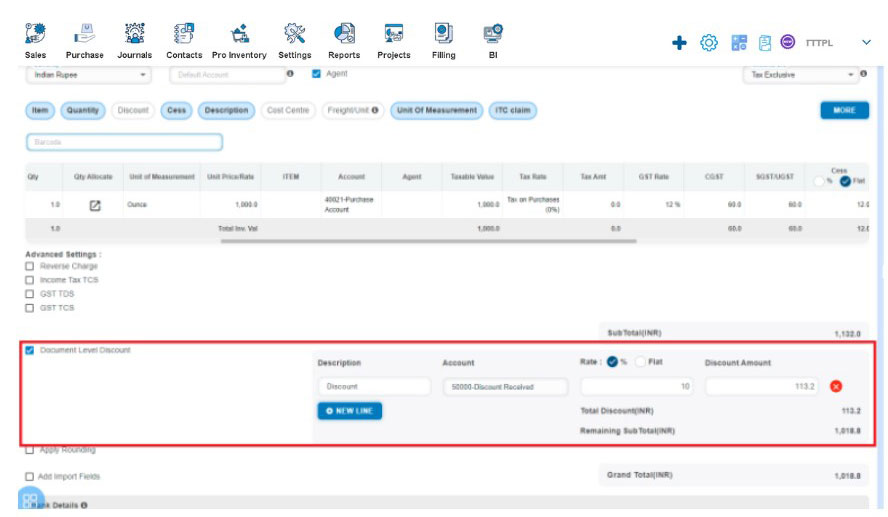

There are 6 types of Advanced settings, out of which 2 i.e. Reverse charge and Document Level Discount will auto appear while creating an invoice, and the rest of 4 i.e. Income Tax TCS, GST TDS, GST TCS, Apply Rounding will appear after checking the same in Customization Settings.

- Create a Bill and click on Reverse Charge then it is auto calculates the reverse charge amount

- Create a Bill and click on Income Tax TCS then Rate & Amount input fields are enabled. You can enter the Income Tax rate and it will calculate the amount automatically.

- Create a Bill and click on GST TDS then Rate & Amount input fields are enabled. You can enter the GST Rate and it will calculate the amount automatically.

- Create a Bill and click on GST TCS then Rate & Amount input fields are enabled. You can enter the GST TCS and it will calculate the amount automatically.

- Create a Bill and click on Document Level Discount then Description, Account, Rate & Discount Amount input fields are enabled.

- Create a Bill and click on Apply rounding then it will round off the Total amount.