TDS Entry in Tally with GST [Payable and Receivable] 2024 Quick Guide

Passing TDS Journal Entry are among the most common yet slightly complex transactions to record in accounting software like Tally. This blog will discuss passing TDS receivable, payable and payment entry in Tally Prime and HostBooks Accounting software.

Here are the Two major types of entries to pass while booking TDS.

TDS Payment Entry

Whenever you are making a payment after deducting TDS, here is the entry you need to pass for Tax Deducted at Source.

| Debit Account | Credit Account | Particulars |

|---|---|---|

| To Expense A/c | – | (Total Amount) |

| – | To Vendor/Supplier A/c | (Amount to be Paid) |

| – | To TDS Payable A/c | (TDS Amount) |

This is a common entry that is passed when expense is booked.

However, booking TDS when the amount is actually paid represents the Accounts payable and helps to determine TDS liability of the period more accurately.

TDS Receivable Entry

Whenever you are receiving an amount after deducting TDS, here is the entry you need to pass for Tax Deducted at Source.

| Debit Account | Credit Account | Particulars |

|---|---|---|

| Bank A/c Dr | – | (Total Amount) |

| TDS Receivable A/c | – | (TDS Amount) |

| – | To Party A/c | (Amount Paid) |

This entry is passed when payment is received.

These are just the journal entries to book TDS payable and receivable. However, you would need to pass 3 more entries of TDS in Tally Prime – one for booking expenses, one for booking TDS and lastly during TDS deposit or refund.

This Blog will discuss provided a comprehensive give to pass TDS journal entry in any accounting software and in Tally. Here is a brief on the topics we will cover.

| Section | Description |

|---|---|

| What is TDS (Tax Deducted at Source)? | Explanation of TDS as a pre-tax deduction mechanism, its types, and its direct deposit to the govt. |

| Calculation of TDS | Factors to consider when calculating TDS deductible, including rates, assessment year, and GST. |

| TDS Payable Journal Entry |

Definition and explanation of TDS Payable, its appearance on the balance sheet, journal entry and an example.

|

| TDS Receivable Journal Entry |

Definition and explanation of TDS Receivable, journal entries, an example, and its relationship with the IT department.

|

| TDS Journal Entry with GST with Example | Explanation of how TDS entries work when GST is charged. |

| Steps for TDS Payable Entry in Tally | Detailed steps to pass TDS Payable entry in Tally, including ledger creation and journal entries. |

| Steps for TDS Receivable Entry in Tally | Detailed steps to enter TDS Receivable in Tally (including ledger creation) and Income Tax Refund |

| FAQs | Answers to common questions related to TDS, Tally, and its accounting treatment. |

What is TDS (Tax Deducted at Source)?

Tax Deducted at Source (TDS) is a mechanism through which the government collects taxes directly from the taxpayer’s income during the payment process. A portion of the payment is directly subtracted by the payer and subsequently remitted to the government on behalf of the payee.

TDS is like when you buy something, and a little bit of the payment is taken out and given to the government before you get the rest. The person who pays you does this and sends the money to the government on your behalf.

Calculating TDS: Formula and Example

Before making any journal entries, it’s important to figure out the TDS amount. This calculation depends on two main factors: the TDS rate and the threshold limit determined by Income Tax Department in TDS rate chart.

*TDS threshold is the amount up to which TDS needs not to be deducted.*

To calculate it, you can use a simple formula.

TDS Amount = Payment Amount × TDS Rate.

Here’s an example:

Let’s say you need to pay a contractor ₹10,000 for services, and the TDS rate for this kind of service is 10%.

TDS Amount = ₹10,000 × 0.10 = ₹1,000

So, you would deduct ₹1,000 as TDS from the payment and give the contractor ₹9,000.

TDS Payable Journal Entry

TDS payable refers to the sum that a company/entity (payer) must withhold from the total payment intended for a service provider, contractor, or professional. This withheld amount is then submitted to the Income Tax department as tax on behalf of the recipient.

Since the amount belongs to the payee and needs to be deposited as Tax paid on behalf of receiver, TDS payable is a liability.

Let’s simplify this concept with a practical example.

Consider yourself a business entity and you need to pay a sum of ₹1,00,000 to a person who provides professional services to your business.

Now as per the Finance Act, you should pay only ₹90,000 to the Professional after deducting ₹10,000 (at the rate of 10% on the total amount payable.) You need to deposit this 10,000 directly to the Income Tax department’s bank account on behalf of the doctor.

Note:

- The 10% deduction rate applies to professional services, specifically under section 194J of the Income-tax Act. Depending on the nature and quantity of payments, TDS deduction rates could vary between 1% and 30%.

- The ₹10,000 that is withheld is treated as if the professional has paid this amount to the IT department. Therefore, TDS doesn’t increase your expenses; it’s a fraction of the payment that is redirected directly to the government instead of the recipient.

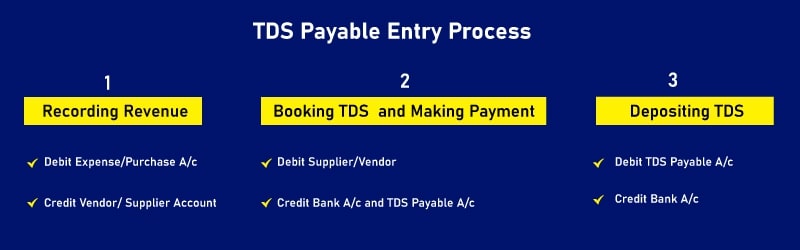

To ensure accurate TDS accounting, there are three necessary transactions, each requiring a separate journal entry:

- 1. Recording Expense: In the initial entry, you record the expense alongside the total amount owed to the payee.

- 2. Making Payment to the Party and booking TDS: The second entry notes the specific amount paid to the payee (after deducting TDS) and booking TDS liability.

- 3. Depositing TDS: The third entry documents the actual deposit of the TDS liability into the Income Tax Department’s account through Challan.

Let’s Pass TDS entry for the Example given above in your Books (Business or Payer)

Recording Expense in the books of Deductor.

| Debit Account | Credit Account | Particulars |

|---|---|---|

| To Expense A/c | – | (Total Amount) |

| – | To Vendor/Supplier A/c | (Amount to be Paid) |

You can also book TDS in the books at the time of booking expense, however it is better if you book when the payment is being made.

Booking TDS while Making Payment (Main Entry)

| Debit Account | Credit Account | Particulars |

|---|---|---|

| To Vendor/Supplier A/c | – | (Total Amount) |

| – | To Bank A/c | (Amount Paid) |

| – | To TDS Payable A/c | (TDS Amount) |

Depositing TDS

| Debit Account | Credit Account | Particulars |

|---|---|---|

| To TDS Payable A/c | – | (TDS Amount) |

| – | To Bank A/c | (Amount Paid) |

TDS Receivable Journal Entry

TDS receivable refers to the amount that is withheld by the company/ payer from payments they make to the payee, and this withheld amount is considered as tax paid on payee behalf.

This withheld amount is an asset for the receiver because it represents money that is owed to you by the withholding party until it is remitted to the appropriate tax authorities.

Example

Consider you provide professional services to a client, and they need to pay you a total of ₹50,000 for your services.

However, as per the tax regulations, they must deduct 10% TDS on this payment and deposit it with the tax department.

So, they will pay you ₹45,000 (₹50,000 – ₹5,000 TDS). The ₹5,000 deducted as TDS is your TDS receivable.

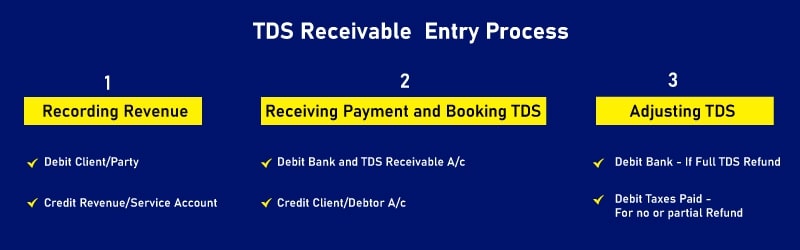

There are three essential transactions that need separate journal entries for accurate TDS accounting when you’re on the receiving end of the TDS:

- 1. Recording Revenue: Initially, you record the revenue earned for your services, along with the total amount due from the client.

- 2. Receiving Payment and Booking TDS Receivable: The second entry reflects the actual amount received from the client (net of TDS) and recognizes the TDS receivable as an asset.

- 3. Receiving TDS Amount: The third entry accounts for the TDS amount that will be considered as Tax paid and adjusted against your tax liability.

Let’s pass the TDS entry for the example given above in your Books (Individual or Service Provider):

1. Recording Revenue

| Debit Account | Credit Account | Particulars |

|---|---|---|

| Client/Debtor A/c | – | (Total Amount) |

| – | Revenue/Service Income A/c | (Amount Earned) |

2. Receiving Payment and Booking TDS (Main Entry)

| Debit Account | Credit Account | Particulars |

|---|---|---|

| Bank A/c | – | (Net Amount Received) |

| TDS Receivable A/c | – | (TDS Amount) |

| – | Client/Debtor A/c | (Total Amount) |

3. Receiving TDS Amount

For Full Refund

| Debit Account | Credit Account | Particulars |

|---|---|---|

| Bank A/c | – | (Refund) |

| – | TDS Receivable A/c | (TDS Amount) |

For Transferring TDS to Tax Paid (for partial Refund)

| Debit Account | Credit Account | Particulars |

|---|---|---|

| Bank A/c | – | (Refund Amount) |

| Tax Paid | – | (Tax Amount) |

| – | TDS Receivable A/c | (TDS Amount) |

TDS Journal Entry with GST

When passing a journal entry for TDS with GST, the process largely remains consistent, with the key distinction being that TDS is applied solely to the taxable value and not to the GST component.

Consider this general example of a TDS entry that incorporates GST:

Let’s say your business avails services from a marketing agency, with a total contract value of ₹80,000. The agency applies a 18% GST on the contract, making the total amount ₹94,400.

For this transaction, the applicable TDS amounts to ₹8,000 (10% of ₹80,000, the taxable amount). Remember that TDS is not levied on the GST component, which is ₹8,000.

Here’s how the journal entry could be structured:

| Debit | Credit | Amount (₹) |

|---|---|---|

| Expense Account | – | ₹80,000 |

| CGST Output | – | ₹7,200 |

| SGST Output | – | ₹7,200 |

| – | To Marketing Agency Account | ₹84,400 |

During Payment

| Debit | Credit | Amount (₹) |

|---|---|---|

| Marketing Agency Account | – | ₹84,400 |

| – | To Bank A/c | ₹ 76,400 |

| – | To TDS Payable | ₹ 8,000 |

Steps to pass TDS Payable Entry in Tally Prime (Same in Tally ERP 9)

Steps to Record TDS Payable Entry in Tally ERP 9 (Applicable to Tally Prime as well) Outlined below are the sequential procedures for incorporating TDS payable entries in Tally ERP 9:

Creation of TDS Payable Ledger (If Not Yet Created)

- 1. Launch the “Gateway of Tally.”

- 2. Access the “Accounts Info” section or press the “A” key.

- 3. Navigate to “Ledgers” or use the keyboard shortcut “L.”

- 4. Opt for the “Create” option or press “C” on the keyboard.

- 5. Enter “TDS Payable” in the name field.

- 6. Select “Current Liabilities” as the ledger group.

- 7. Simultaneously press Ctrl+A to save the ledger.

Journal Entry for Recording the Expense /Transactions

- 1. Open the “Gateway of Tally.”

- 2. Navigate to the “Accounting Vouchers” section or press “V.”

- 3. Use the keyboard shortcut “F7” to initiate the journal entry.

- 4. Insert the relevant expense ledger for the expenses being recorded (e.g., Rent, Contract, Professional Fee).

- 5. Input the total payable amount prior to TDS deduction and press “Enter.”

- 6. Choose the payee to whom the payment is directed.

- 7. Press “Enter.”

- 8. Input the total amount and press “Enter.”

(Alternatively)

Press “Alt + C” to craft a new expense ledger.

(Alternatively)

Press “Alt + C” to generate a new ledger.

Recording TDS Payable at While Making Payment

You need to pass it in two different entry.

Entry 1- Payment

- 1. Access the “Gateway of Tally.”

- 2. Navigate to the “Accounting Vouchers” section or press “V.”

- 3. Use the keyboard shortcut “F7” to pass Journal Entry.

- 4. Select the payment account (e.g., Bank, Cash, etc.).

- 5. Choose the Vendor/Payee to whom the payment is being made.

- 6. Input the amount paid to the payee.

- 7. Press “Ctrl + A” to save the journal voucher.

Entry 2- TDS

- 1. Press F7 to pass Journal Entry

- 2. Select Vendor/ Payee for whom TDS is being booked.

- 3. Enter amount of TDS payable

- 4. Select “TDS payable A/c”

- 5. Press enters or “Ctrl +A to save”

Entry for Depositing TDS Payable Amount

- 1. Open the “Gateway of Tally.”

- 2. Navigate to the “Accounting Vouchers” section or press “V.”

- 3. Use the keyboard shortcut “F5” to input payment entries.

- 4. Select the payment account (e.g., Bank, Cash, etc.).

- 5. Choose “TDS Payable.”

- 6. Input the net amount being deposited.

- 7. Press “Ctrl + A” to save the journal voucher.

Steps to Record TDS Receivable Entry in Tally Prime (Applicable to Tally ERP as well)

Outlined below are the systematic procedures for capturing TDS receivable entries in Tally ERP:

Creation of TDS Receivable Ledger (If Not Yet Created)

- 1. Initiate the “Gateway of Tally.”

- 2. Access the “Accounts Info” section or press the “A” key.

- 3. Navigate to “Ledgers” or use the keyboard shortcut “L.”

- 4. Opt for the “Create” option or press “C” on the keyboard.

- 5. Enter “TDS Receivable” in the name field.

- 6. Select “Current Assets” as the ledger group.

- 7. Simultaneously press Ctrl+A to save the ledger.

Journal Entry to Register Income in Tally (When Issuing Invoice)

- 1. Launch the “Gateway of Tally.”

- 2. Navigate to the “Accounting Vouchers” section or press “V.”

- 3. Use the keyboard shortcut “F7” to initiate the journal entry.

- 4. Input the customer/client account to whom the bill is being issued.

- 5. Enter the total receivable amount before TDS deduction and press “Enter.”

- 6. Insert the revenue ledger for the income being recorded (e.g., Professional, Contract, etc.).

- 7. Press “Enter” twice.

- 8. Press “Ctrl + A” to save the journal voucher.

(Alternatively)

Press “Alt + C” to craft a new customer/client ledger.

(Alternatively)

Press “Alt + C” to create a new ledger.

TDS Receivable Entry When Receiving the Amount

Two entries are required to book TDS receivable:

Payment Entry

- 1. Open the “Gateway of Tally.”

- 2. Navigate to the “Accounting Vouchers” section or press “V.”

- 3. Use the keyboard shortcut “F6” to input receipt entries.

- 4. Select the appropriate receipt ledger (e.g., Bank, Cash, etc.).

- 5. Choose the party from whom the amount is being received.

- 6. Enter the net amount received from the client/customer.

- 7. Press “Ctrl + A” to save the journal voucher.

TDS Receivable Book

- 1. Access the “Gateway of Tally.”

- 2. Navigate to the “Accounting Vouchers” section or press “V.”

- 3. Use the keyboard shortcut “F7” to initiate the journal entry.

- 4. Select the “TDS Receivable” ledger.

- 5. Input the total TDS amount deducted and press “Enter.”

- 6. Enter the customer/client ledger.

- 7. Press “Enter.”

- 8. Press “Ctrl + A” to save the journal voucher.

Final Adjustment Entry

This will depend on whether the TDS is transferred to Taxes Paid A/c or refunded partially or wholly.

FAQs about TDS Entry

1. What is journal entry for TDS?

The entry passed in the books of account of deductor or deductee to book the amount deducted as Tax is TDS journal entry. For TDS Payable, you need to credit the TDS payable a/c with the amount that id deducted as TDS during the payment and debit the vendor/supplier with same amount. For TDS receivable, debit the TDS receivable a/c with the amount that is deducted during the payment and credit the customer/client with the same amount.

2. How do I record TDS entries?

TDS entries can be recorded by passing a journal account in which TDS payable/receivable account is either credited or debited depending on whether you are deductee or deductor and credit/debiting the vendor or customer’s as necessary.

3. What is the journal entry for TDS on salary?

The journal entry for TDS on salary is.

Salary A/c Dr.

To Salary Payable A/c

To TDS payable A/c

4. How is TDS calculated in Tally ERP 9?

TDS should be calculated manually in Tally ERP 9. You can just pass journal entry in tally to book TDS after calculation.

5. Why is TDS credited in journal entry?

TDS is credited in Journal entry only in the books of A/c of deductor as it’s a part of payment of the vendor which needs to be deposited, hence a liability. If you are the deductee to whom the payment is being made, you need to put up TDS receivable as an asset by debiting it.

6. Is TDS an expense or income?

TDS is neither an expense nor an income. It is a part of payment being made or received, that is not directly deposited or received in account but received as tax paid.

7. How is TDS shown in the balance sheet?

TDS payable is shown as liability while TDS receivable is shown as current asset in the balance sheet.

8. Is TDS receivable an asset?

Yes, TDS receivable could be treated as advance tax deposited. Hence, it’s an current asset.

9. Is TDS an indirect expense?

No, TDS payable is a part of payment that is not directly deposited in the bank account.

10. What type of account is TDS?

TDS is a Real Account as it mainly refers to liability or assets.

Try HostBooks

SuperApp Today

Create a free account to get access and start

creating something amazing right now!