GSTR-4: Meaning, Eligibility, Due Date, Format, Process & Penalty

Under the broad and crystal clear circumference of GST regime, every taxpayer needs to execute his/her liability seriously and on time. Keeping in view one’s, ease various kinds of GSTR forms have been brought by the Govt.

GSTR-4 is like other GSTR Forms, which is subjected to dealers registered under composition scheme of GST and they have to furnish this GSTR-4 electronically by 18th of the month succeeding quarter.

This blog post contains abundant information regarding your queries for-

- What is GSTR-4?

- Who should File GSTR-4?

- What is Due date for Filing GSTR-4?

- What is the Format of GSTR-4?

- How to File GSTR-4 on the Govt. Portal?

- What is the penalty to be paid in case of non- filing?

What is GSTR-4?

GSTR-4 is a GST Return Form that has to be filed quarterly by a Composition Dealer. In Form GSTR-4, the composition dealer is required to specify only the total value of supply made during the period of return and the total tax paid at the compounding rate accompanied by the details of the payment of tax in the return.

Who Should File GSTR-4?

GSTR-4 is strictly subjected only to GST Composition Scheme which is a simple and easy scheme under GST. Small taxpayers, under this scheme can get rid of tedious GST formalities and pay GST only at a fixed rate of turnover. This scheme can be opted by any taxpayer whose annual turnover is not more than ₹ 1.5 Crore.

What is the Due Date for Filing GSTR-4?

GSTR-4 has to be filed on a quarterly basis.

Hence, the due date for filing GSTR-4 is 18th of the month after the end of the each quarter.

(a) Due date for April 2018 to June 2018 will be 18th July 2018

(b) Due date for July 2018 to September 2018 will be 18th October 2018

(c) Due date for October 2018 to December 2018 will be 18th January 2018

(d) Due date for January 2018 to March 2018 will be 18th April 2018

What is the Format of GSTR-4?

Mainly, there are 22 headings in GSTR-4 filing format prescribed by the Govt.

And to understand each heading separately, here we shall read it in a well explained way along with the details required to be furnished under GSTR-5.

| S. N. | Headings | Details to be furnished |

|

1. |

GSTIN (Goods and Services Taxpayer Identification Number ) | 15 digit (state-wise) PAN number |

|

2. |

Legal Name of the Taxpayer and trade name if any | Will be auto-populated when a taxpayer will login to the common GST portal (www.gst.gov.in) |

|

3. |

Tax Period / period of return | Period / Quarter and year of tax to which the Return pertains to be selected from drop-down menu |

|

4.

|

Taxable Inward Supplies to a composition dealer | In the case intra-state supplies, details will be auto-populated Manual details to be entered for the inward supplies from an unregistered person. Supply under reverse mechanism will also get included in inward supply. |

| 5.

|

Modifications to Details of Inward Supplies Received in Earlier Tax Periods | Here, the composition dealer can manually amend any detail with respect to goods or services received in earlier Quarters, including supply from the unregistered person or composition dealer. |

|

6.

|

Imported goods /capital goods (received from overseas) | Under GST, imports (goods or capital goods received from overseas) are considered as inter-state supply and hence any such goods/services received, need to be furnished under this head |

|

7.

|

Modifications to Details of Imported goods / capital goods; received in Earlier Tax Periods | Any amendment in tax calculated on imported goods is presented under this heading along with details of the entire changes in the bill of Entry / Import Report. |

|

8.

|

Services imported from overseas (received from overseas supplier) | Alike goods imported, services imported by a composition dealer also need to furnish here. According to GST Act, a Service importer needs to pay GST if such services are received from overseas. Imported services will fall under Reverse Charge Mechanism of the collection of GST. |

|

9.

|

Modifications to Details of Imported services; received in Earlier Tax Periods | Any amendment in tax calculated on imported services is presented under this heading along with details of the entire changes in the bill of Entry / Import Report. |

|

10.

|

Outward Supplies Made | Outward supplies include intra-state made by a Composition dealer. S/he is required to report details of all outward supplies under this head. |

| 11. | Modifications to outward supplies related to intra-state supplies; received in Earlier Tax Periods | Any amendment in outward supply from earlier tax period is presented under this head. Such modifications will also have an impact on the tax liability of a composition dealer. |

|

12.

|

Debit notes and credit notes details | All debit and credit notes that are raised must be reported by a composition dealer. Debit note of counter-party will be auto-populated as composition dealer’s credit note and vice-versa. |

|

13.

|

Amendment to debit or credit notes of earlier tax periods | Any amendment in debit /credit note pertaining to previous Quarters shall be reported under this heading. |

| 14. | Receipt of TDS credit during the Quarter | Any tax credit receipt by a composition dealer related to TDS will be auto populated from counter-party GSTR-7. |

|

15.

|

Tax Liability arising on account of the time of supply without receipt of Invoice (under reverse charge) | Under this head, GST liability under reverse charge due to charge due to the time of supply falls under current tax period is required to be reported. |

| 16. | Modifications in Tax Liability arising on account of the time of Supply without receipt of Invoice (under Reverse Charge) | Any modifications pertaining to GST liability under reverse charge as a result owing to charge due to the time of supply falls under current tax period is recorded under this head |

|

17.

|

Tax already paid on account of the time of supply for invoices received in the current period relating to reverse the charge | Apart from tax liability, the tax amount that has already been paid by a composite dealer shall be reported under this head. |

|

18.

|

Tax Liability Payable | Based on the entire information that has been furnished above, the composition dealer’s GST liability will get auto-populated here. |

|

19. |

Tax Payment details | Tax liability as calculated in the previous heading, needs to be paid either by debiting Electronic Credit Ledger or Electronic Cash Ledger. Details of such debit will be retained under this head. |

|

20.

|

Refunds Claimed | A composition dealer can claim a refund of Input Credit amount in excess of tax liability in this header. The excess of TDS over tax liability will get auto-populated here as refund. |

|

21.

|

At the end, GSTN will ensure if a composition dealer is likely to cross composition limit before the date of next return: Y/N | In case, a composition dealer exceeds the threshold limit, he must pay taxes under the normal provision. Such affirmation is obtained from the composition dealer u |

How to File GSTR-4 on the GST Portal (www.gst.gov.in)?

To understand the entire process for filing GSTR-4, we should go step by step.

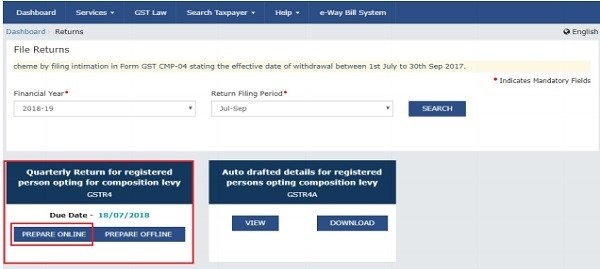

Step-1: Go to GST Portal (www.gst.gov.in).

Step-2: Click on ‘Return’ in the Dashboard.

Step-3: Answer the questions in YES/No form and that will enable the relevant section to appear on the next screen. Once all the questions will be properly answered, click on ‘NEXT’ at below part of the screen. The set of questions include-

(a) Do you want to file Nil Return?

(b) Have you made inward supplies (other than reverse charge supplies) during the Period (Table 4A)?

(c) Have you made inward supplies (reverse charge supplies) during the Period (Table 4B)?

(d) Have you received any supplies from an unregistered suppliers during the period (Table 4C)?

(e) Have you import any services (Table 4D)?

(f) Do you intend to amend inward supplies reported in Table 4A (other than reverse charge) (Table 5)?

(g) Do you intend to amend inward supplies reported in Table 4B (reverse charge) (Table 5)?

(h) Do you intend to amend inward supplies reported in Table 4C (supplies received from an unregistered suppliers) (Table 5)?

(i) Do you intend to amend import of services reported in Table 4C (Table 5)?

(j) Have you received any debit/credit note (Table 5B)?

(k) Do you intend to amend debit/credit note reported in Table 5B (Table 5C)?

(l) Have you made any outward supply during the Quarter (Table 6)?

(m) Do you intend to amend outward supplies reported in Table 6 (Table 7)?

(n) Have you paid any advances amount for reverse charge inward supplies or made adjustment there in {Table 8A (1) / 8(A) (2) / 8(B) (1)/ 8(B) (2)}?

(o) Do you intend to amend advances amount for reverse charge inward supplies {Table 8A (1) / 8(A) (2) / 8(B) (1)/ 8(B) (2)?

(p) Do you intended to claim refund from cash ledger (Table 12)?

(q) Previous period(s) / return (s) liability, if any: Previous period(s) / return (s) liability would be system determined?

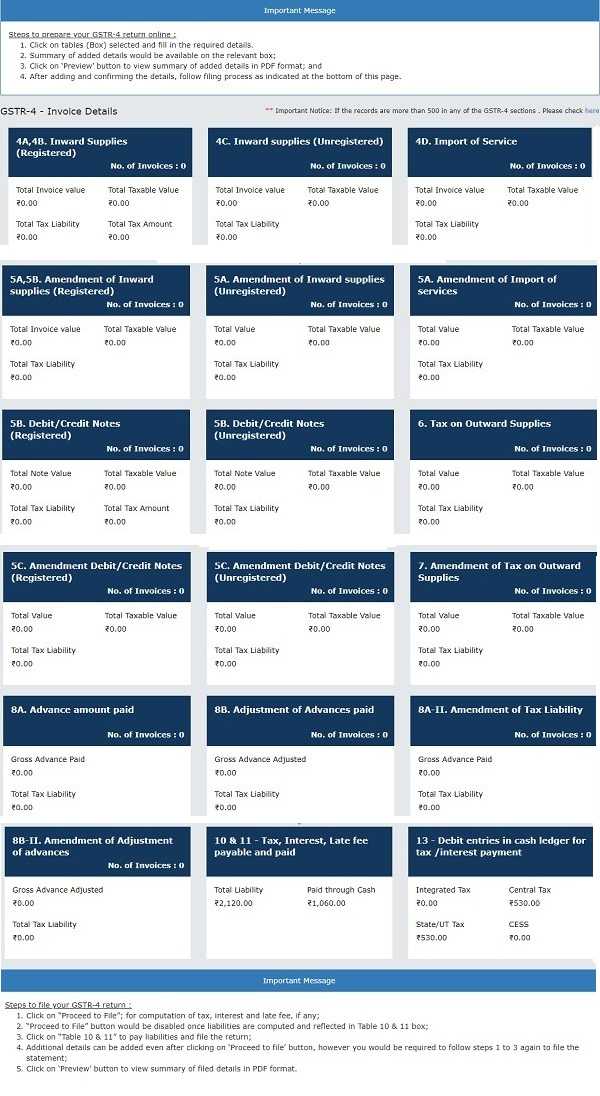

Step-4: Enter all the necessary details in relevant tiles.

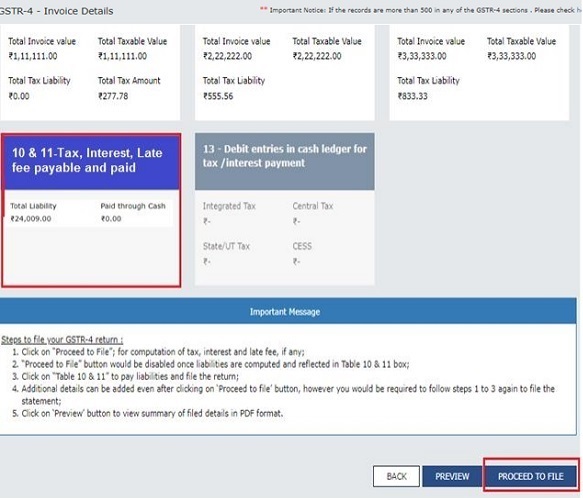

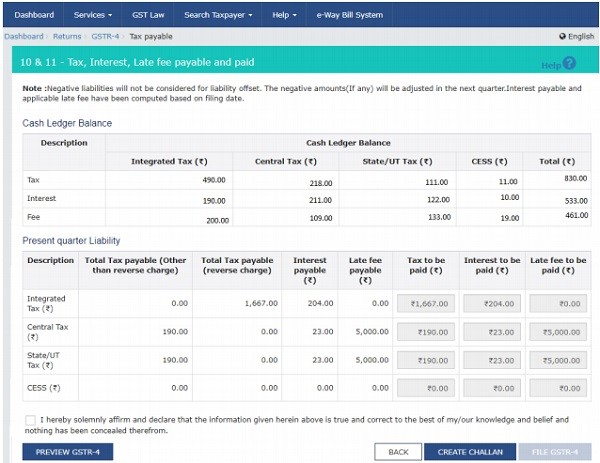

Step-5: Then click on ‘PROCEED TO FILE’ at below (for computation of tax, interest and late fee, if any). The tile 10 & 11-Tax, Interest, Late fee payable and paid is populated with dues also Ready to File as on Current Date appears on the screen.

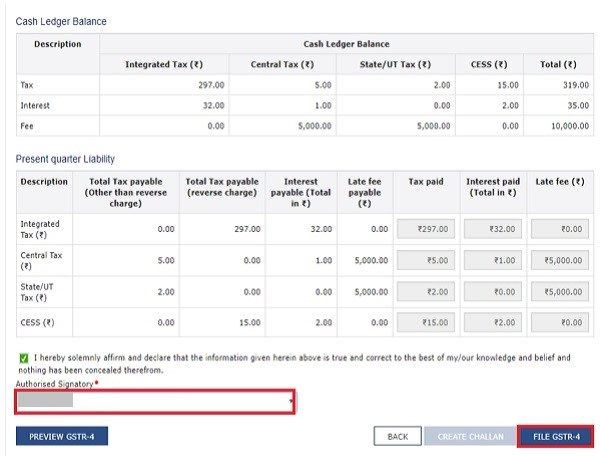

Step-6: And, now click the Tile 10 & 11-Tax, Interest, Late fee payable and paid. Verify the amount due in the section Present Quarter Liability.

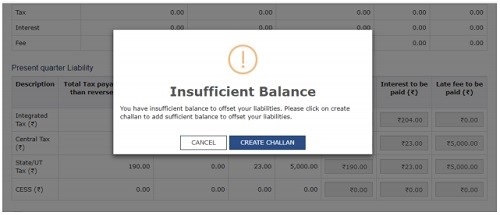

Step-7: Now, click on ‘FILE GSTR-4’, a pop up ‘Insufficient Balance’ will appear on the screen (if only the Funds are less), prompting taxpayer to make payment via CREATE CHALLAN.

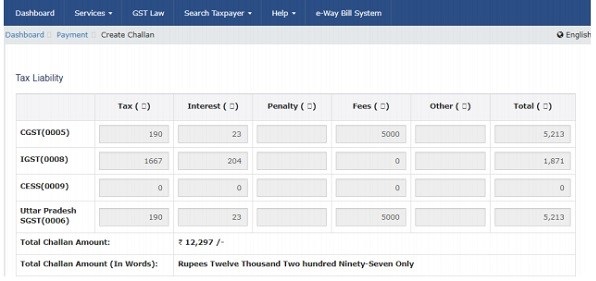

Step-8: Any taxpayer can make the payment by clicking ‘CREATE CHALLAN’. There will be an option to pay via E-payment, over the counter or NEFT/RTGS.

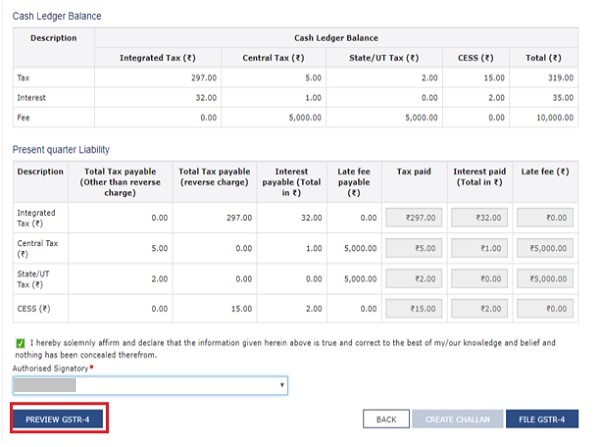

Step-9: As soon as the payment is made, the Cash Ledger Balance section gets updated automatically. And now, the taxpayer is navigated back to GSTR4 Tax Payable page.

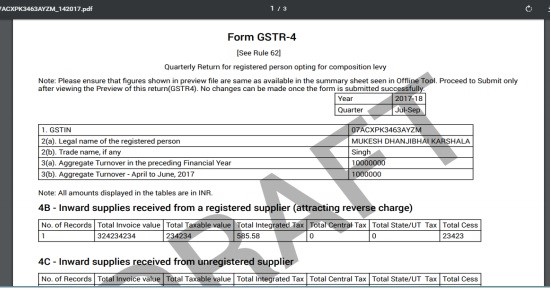

Step-10: Now, click on ‘PREVIEW GSTR-4’. A pdf file will show the summary which should be saved for future references by the taxpayer.

Step-11: Once the Taxpayer becomes fully satisfied with the Returns Filed, select the declaration Checkbox along with ‘Authorized Signatory’ and then click on ‘FILE GSTR 4’.

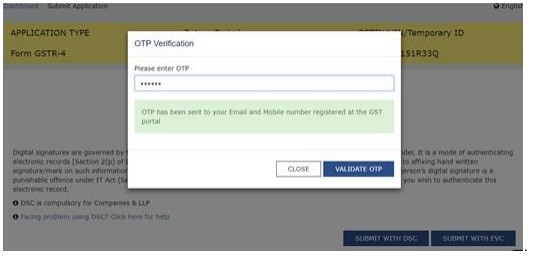

Step-12: The exact due amount will offset the amount due and taxpayer will be navigated to the verification page. Here, complete the process of Filing GSTR-4 by providing the OTP in case of EVC or just by using DSC.

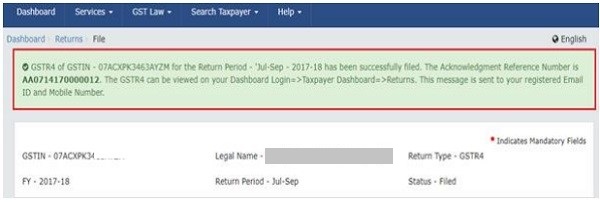

Step-13: Once the Verification is done successfully, unique ARN gets generated and status gets changed to Filed.

What is the Penalty to be Paid in Case of Non-filing GSTR-4?

It is difficult to escape from the transparent and strict procedures of GST. And there are various strict rules and penalties for different cases and conditions.

- A penalty of ₹ 200 / day is prescribed to be levied if the GSTR-4 is not filed.

- The maximum penalty that can be charged is ₹ 5,000.

N.B.– if the GSTR-4 is not filed on time (for a given quarter), the taxpayer cannot file the next quarter’s return as well.

As per latest notification, Central Tax late fees for GSTR-4 has been reduced to ₹ 50 / day of default. Moreover, the late fees for NIL return in GSTR-4 have been reduced to ₹ 20 / day of delay.

Conclusion

Filing GSTR-4 on time and in the prescribed format is quite necessary for dealers registered ‘GST Composition Scheme’. But if failed in doing so, it may cause big troubles further.

Try HostBooks

SuperApp Today

Create a free account to get access and start

creating something amazing right now!