Goods and Services Tax – Transforming the Indirect Taxation System!

What is GST (Goods and Service Tax) and how is it beneficial for all?

Table of contents:

Through this article, we will get detailed view of GST-its calculation and how it is befitting manufacturer, Trader (businesses) and consumers:

- What is GST?

- Tax Rates under GST

- GST Returns

- Tax Structure

- Tax Calculation

- Benefits of GST

- Components of GST

- Compliance under GST

What is GST?

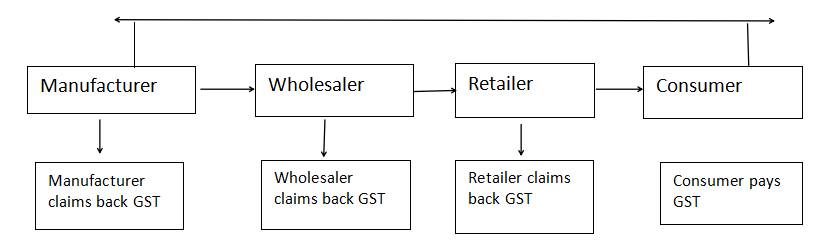

GST (Goods & Service Tax) is a single tax applicable to the supply of goods and/or services right from the manufacturer to consumer. Being an indirect tax, it has subsumed (replaced) many indirect taxes such as VAT, Excise duty, Service tax and others. Credits of input taxes are paid at each stage and are available in the subsequent stage of value addition, which makes it essentially a tax applied only on value addition at each stage. The final consumer (consumption-based tax) would have to bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

In other words, Goods and Services Tax law can be understood as a comprehensive, multi-stage, destination-based tax that is levied on every value addition. It is considered as a single domestic indirect tax law for the entire country.

Tax rates under GST

The GST Council has assigned GST rates to different goods and services. While some products are purchased with none GST, there are others that come at 0% GST, 3% GST, 5% GST, 12% GST, 18% GST, and 28% GST. GST rates for goods and services are changed some time since the new tax regime was implemented from 1st-July-2017.

GST Returns

GST return is kind of a document containing details of income (Sales) which a taxpayer is required to file with the tax administrative authorities. This is often utilized by tax authorities to calculate liabilities.

Under GST, a registered dealer needs to file GST returns that include:

1. Purchases

2. Sales

3. Output GST (On sales)

4. RCM (GST paid on purchases)

GST compliance purchase and sales invoices are required to file GST returns.

Types of GST Returns

| 1 | GSTR-1: This return is for outward supplies (Sales) |

| 2 | GSTR-2A: This is auto-populated return for inward supplies (Purchase) |

| 3 | GSTR-3B: This is summary of inward and outward supplies |

| 4 | GSTR-4/CMP-08: This return is for composition dealers |

| 5 | GSTR-5/5A: This return is for non-resident taxable persons and OIDAR |

| 6 | GSTR-6: This return is for input service distributors (ISD) |

| 7 | GSTR-7: This return is for taxpayers deducting TDS |

| 8 | GSTR-8: This return is for e-commerce operators collecting TCS |

| 9 | GSTR-9: This annual return is for all normal taxpayers |

| 10 | GSTR-9A: This annual return is for composition dealers |

| 11 | GSTR-9B: This annual return is for e-commerce operators collecting TCS |

| 12 | GSTR-9C: This return is for taxpayers whose accounts audited by a CA |

| 13 | GSTR-10: This return is for the taxpayer whose GST registration is canceled |

| 14 | GSTR-11: This return is for Unique Identification Number holders |

Tax Structure

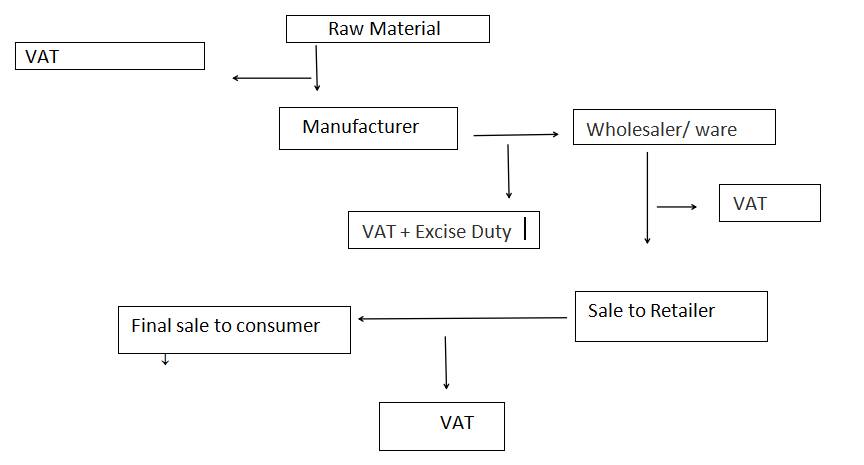

Before the advent of Goods or Services, the structure of indirect tax (old tax regime) levied in India was as follows:

Previous tax structure

As per the GST regime, the tax is levied at every point of sale. In the case of intra-state sales, Central GST and State GST are being charged. All the inter-state sales are being charged to the Integrated GST.

GST structure (GST at 6%)

Tax Calculation (Old tax regime VS GST)

Let’s understand the process of tax calculation of under old tax regime and GST:

| Manufacturer Value | Old tax System | GST (New tax system) |

| Production Cost | Rs. 3,00,000 | Rs.3,00,000 |

| Profit Margin (10%) | Rs.30,000 | Rs.30,000 |

| Excise duty (12%) | Rs.36,000 | – |

| Total production cost | Rs.3,66,000 | Rs.3,30,000 |

| VAT (12.5%) | Rs.45,750 | – |

| SGST of (6%) | – | Rs.19,800 |

| CGST (6%) | – | Rs.19,800 |

| Invoice value for manufacturer | Rs.4,11,750 | Rs.3,69,600 |

| Value to Wholesaler | ||

| Cost of goods | Rs.4,11,750 – 45,750 = 3,66,000 | Rs.3,69,600 – 39600 = 330000 |

| Profit margin (10%) | Rs.36,600 | Rs.33,000 |

| Total Value | Rs.4,02,600 | Rs.3,63,000 |

| VAT (12.5%) | Rs.50,325 | – |

| SGST of 6% | – | Rs.21,780 |

| CGST of 6% | – | Rs.21,780 |

| Invoice value to wholesaler | Rs.4,52,925 | Rs.4,06,560 |

| Value to Retailer | ||

| Cost of goods | Rs.4,52,925 – 50,325 = 4,02,600 | Rs.4,06,560 – 43,560 = 3,63,000 |

| Profit margin of 10% | Rs.40,260 | Rs.36,300 |

| Total Value | Rs.4,42,860 | Rs.3,99,600 |

| VAT of 12.5% | Rs.55,357.50 | – |

| SGST of 6% | – | Rs.23,958 |

| CGST of 6% | – | Rs.23,958 |

| Invoice value to retailer | Rs.4,98,217.50 | Rs.4,47,216 |

Benefits of GST

Benefits to business and industry

Easy compliance: A sturdy and comprehensive IT system is the inspiration of the GST regime in India. Therefore, all taxpayer services like registrations, returns, payments, etc. would be available to the taxpayers online, which might make compliance easy and transparent.

Tax uniformity: GST will make sure that tax rates and structures are common across the country, thereby increasing certainty and ease of doing business. In other words, GST would make doing business within the country tax neutral, regardless of the selection of place of doing business.

No cascading effect: A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would make sure that there’s minimal cascading of taxes. This may reduce the hidden costs of doing business.

Healthy competitiveness: Reduction in transaction costs of doing business would eventually cause improved competitiveness for the trade and industry.

Benefits to manufacturers and exporters:

The subsuming of major Central and State taxes in GST, complete and comprehensive set-off of input goods and services, and phasing out of Central sales tax (CST) would scale back the price of locally manufactured goods and services. This may increase the competitiveness of Indian goods and services within the international market and provides a boost to Indian exports. The uniformity in tax rates and procedures across the country also will go a protracted way in reducing the compliance cost.

Benefits to the Taxpayers:

A single and transparent taxation system: Just because of multiple indirect taxes being levied by the Centre and State, with incomplete or no input tax credits available at progressive stages, the price of most goods and services within the country today were laden with many hidden taxes. Under GST, there would be only one tax from the manufacturer to the consumer, resulting in the transparency of taxes paid to the final consumer.

Relief in overall tax burden: Due to efficiency gains and prevention of leakages, the general tax burden on most commodities will come down, which is able to benefit consumers.

Benefits to the Central and State Governments:

Easy and simple to administer: Multiple indirect taxes at the Central and State levels have been replaced by GST. Backed with a sturdy end-to-end IT system, GST would be simpler and easier to administer than all other indirect taxes of the Centre and State levied thus far.

Better controls on leakage: GST leads to better tax compliance because of a strong IT infrastructure. The seamless transfer of input reduction from one stage to a different within the chain important addition, there’s an in-built mechanism within the design of GST that might incentivize tax compliance by traders.

Higher revenue efficiency: GST decreases the value of a collection of tax revenues of the Govt. and can, therefore, result in higher revenue efficiency.

Components of GST

There are three components applicable under this system: CGST, SGST, & IGST:

- CGST: CGST is the tax collected by the Central Government on an intra-state sale.

- SGST:SGST is the tax collected by the state government on an intra-state sale

- IGST: IGST is a tax collected by the Central Government for an inter-state sale.

Compliance introduced under GST

Apart from the online filing of the GST returns, the GST regime has introduced several new systems together with it.

E-way Bills

- Way bill or Electronic-way billis adocument introduced under the GST regime that must be generated before transporting or shipping goods worth over INR 50,000 within state or interstate. The physical copy of the e-way bill must be present with the transporter or the person answerable of the conveyance and may include information like goods, recipient, consignor, and transporter. The e-way bill was extended nationwide on 1st April 2018.

E-Invoicing

The GST Council, in its 35th meeting, has decided to implement a system of e-invoicing, which is able to be applicable to specified categories of persons. E-invoicing isn’t the generation of invoice on GST portal. It’s a myth. E-invoicing is that the submission of an already generated standard invoice on a typical portal. Thus it is capable in automating multi-purpose reporting with a one-time input of invoice details.

The coming years of GST would bring transparency and corruption-free tax administration, by removing shortcomings in revenue enhancement structure. GST is not only business-friendly but also consumer-friendly too. There was a need for a change within the taxation system which is better than earlier taxation.

Thus, GST is a win-win scenario that is benefiting the entire value chain and making taxation easier for both businesses and consumers.

Have thoughts?

Try HostBooks

SuperApp Today

Create a free account to get access and start

creating something amazing right now!

9 Comments

Hello! The thanks for sharing this information about Goods and Services Tax – Transforming the Indirect Taxation System!

I read your blog. It’s very nice and very useful for me. Thanks for sharing useful information with us. I’m India Tax and we provide Taxation, GST, Assurance, Consulting, Mergers and Acquisition to Corporate Financial Advisory and also provide franchise for more information

I read your blog. It’s very nice and very useful for me. Thanks for sharing useful information with us.

Can u give comparasion of government income in pre GST and post GSt regim

The stats are given below based on the Press Release issued by PIB, Ministry of Finance, Govt. of India Dt. 14 Dec, 2018, 08 Feb, 2019 and GST Council. [You may refer> https://www.pib.gov.in/indexd.aspx & > http://www.gstcouncil.gov.in/ for more update related to your comment]

(Rs. in crore)

Financial Year

Non-GST Collections

GST Collection

Total

2015-16

709825

—-

709825

2016-17

861625

—-

861625

2017-18

469092 [Provisional]

740650 [GST Council]

2018-19

289661 [Provisional, up to Jan 2019]

1177369 [GST Council]

Find Link below;

https://www.pib.gov.in/PressReleseDetail.aspx?PRID=1555999

https://pib.gov.in/Pressreleaseshare.aspx?PRID=1563555

Hello Sir, I have read your blog and I get much information from your knowledgeable article. I was looking for information about tax services and I came across your blog which I found very informative. Everyone should have knowledge about Our GST process which your providing. i appreciate your effort. anywways good article.

Hello Sir, I have read your blog and I get much information from your knowledgeable article. I was looking for information about tax services and I came across your blog which I found very informative. Everyone should have knowledge about Our GST process which your providing. i appreciate

I have a question:

Suppose I am a stone chip manufacturer for which I have taken gst registration. Now, I have to open a servicing station in the same town. Should I get a fresh registration for this servicing station ?

As per section 25 of the CGST Act, a person having multiple places of business in a state/union territory may be granted a separate registration for each place of business subject to conditions as may be prescribed in rule 11.

Conditions of Rule 11 for separate registration in a same state or union territory is given below:

1. Any person having multiple places of business within a State or a Union territory shall be granted separate registration only if following conditions are satisfied –

Such person has more than one place of business as defined in section 2 (85).

Such person shall not pay tax under composition scheme for any of his place of business if he is registered under regular scheme for any of its business.

In case of supply by one registered unit to another registered unit for the goods or services or both, the registered person is required to issue tax invoice or a bill of supply and pay applicable tax on the same.

2. The registered person opting to obtain separate registration for a place of business shall submit a separate application in FORM GST REG-01 in respect of such place of business.

In Short, Separate registration is not a mandatory requirement for multiple place of business in a state or a union territory but if you want a separate registration then you can get a fresh registration.