A Complete Guide to GST Registration Online – Eligibility, Process, and Fees

If you are about to get started on Goods and Services Tax, then it goes without saying that registration is the first step that needs your attention. So, if you are still unclear about the GST registration process, then this article would walk you through the entire registration process, eligibility, and fees.

Let’s proceed step by step.

- GST Registration: Meaning and Importance

GST registration is the process of registering goods or service provider as a normal taxpayer if his turnover exceeds 20 lakhs INR. The threshold limit for the turnover is 10 lakhs INR for the North Eastern and Hilly states.

If any goods or services provider carries on with his business without registration, then he would be considered as a defaulter in the eyes of the law and would also be liable to pay heavy penalties.

- The businesses to be registered under GST:

Any business whose turnover exceeds 20 lakhs INR (10 lakhs INR in case of North Eastern and Hilly States) is supposed to get registered under GST. The businesses that were registered in the Pre-GST regime i.e. under VAT, Excise, Service Tax will have to be registered under GST as well.

- The businesses to be mandatorily registered under GST irrespective of their turnover limit:

- Every business registered under VAT, Excise, Service Tax in the Pre-GST regime.

- Casual taxable person.

- Agents of a supplier.

- Non-Resident taxable person.

- Input Service Distributor.

- In case a business is transferred to some other party, the transferee will be responsible for registering the business w.e.f. the date of transfer.

- Anyone who undertakes inter-state supply of goods. As per the latest GST updates, the turnover limit has been defined as 20 lakhs INR (10 lakhs INR for special states and 20 lakhs INR for J&K).

- Businesses paying tax under Reverse Charge Mechanism.

- E-commerce operator or aggregator. As per latest GST updates, e-commerce sellers or aggregators are exempted from registration if the turnover is below 20 lakhs INR.

- A person who supplies via e-commerce aggregator.

- A person supplying online information, database access or retrieval services from abroad to a person in India, other than a registered taxable person.

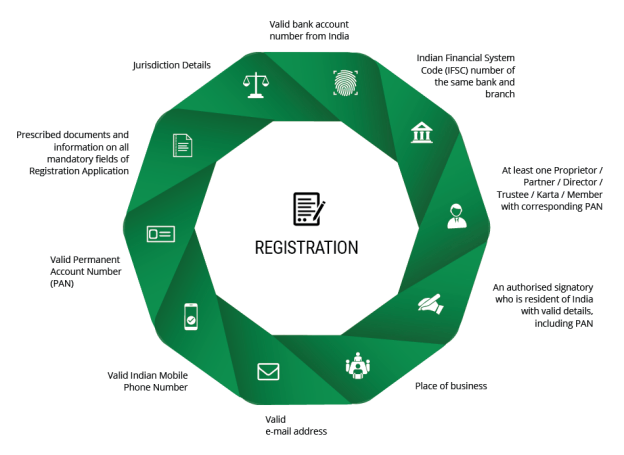

- The documents required for the purpose of GST registration:

Here is a list of all the documents that are required to get registered under GST.

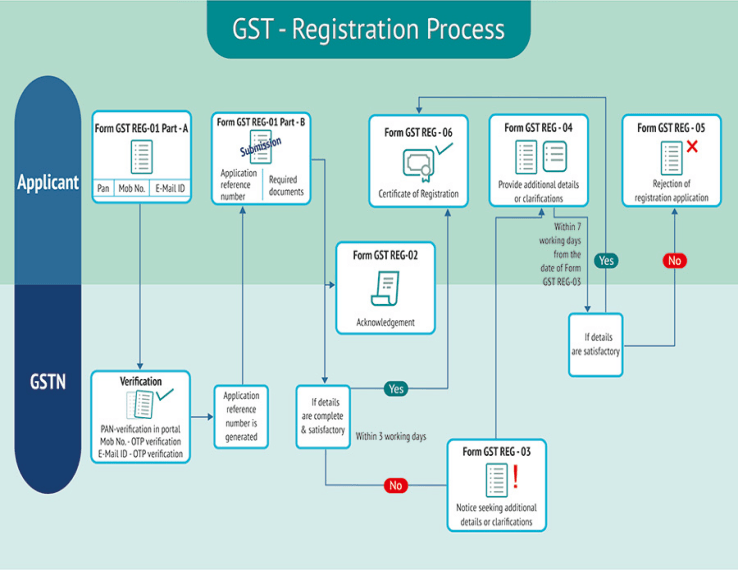

- The GST registration process:

Get started with GST after completing the registration process via the Government GST online portal or GST Seva Kendra. A step by step guide on how to register under GST.

- The fees for GST registration:

There is no registration fee for GST. All you need to do is log in to the online GST portal and follow the steps involved in the registration process.

Sign up on HostBooks GST now and we will help you achieve your GST goals.

https://www.hostbooks.com/in/gst-registration/

- The penalty imposed in case of failure to register under GST:

A business that fails to register under GST has to pay a penalty of 10% of the amount due subject to a minimum of 10,000 INR. If the tax evasion is done intentionally, then the penalty will be 100% of the tax amount due.

- Multiple GST registrations:

If a business is carried out in more than one state, then a separate registration is required for each state. In case a business has multiple verticals in a state, a separate registration can be obtained for each business vertical.

- What is Composition scheme?

The GST rules Composition scheme is an easy and convenient tax scheme for small and medium enterprises. Under this scheme, firms can pay a fixed percentage of their turnover as tax. They need to file a small number of returns compared to normal taxpayers under GST. The floor rate of tax for CGST and SGST shall not be less than 1%. The turnover of an enterprise should be up to 1.5 crore INR and in case of the North-Eastern States and Himachal Pradesh, it should be 75 lakhs INR.

Who can avail composition scheme?

A dealer who:

- Deals only in the intra-state supply of goods or service of only restaurant sector.

- Does not supply non-taxable goods.

- Pays tax at normal rates in case he is liable under reverse charge

- Is not an e-commerce operator.

- Is not a manufacturer of ice cream, pan masala or tobacco (and its substitutes).

| GST rates for Composition Scheme | |||

| Business type | CGST | SGST | Total |

| Manufacturer | 1% | 1% | 2% |

| Traders (For goods) | 0.5% | 0.5% | 1% |

| Supplier of food and drinks (Except alcohol) | 2.5% | 2.5% | 5% |

| Note: Service providers are not eligible for this scheme. | |||

For easy and effortless GST return filing and billing, reach us now at https://www.hostbooks.com/in/.

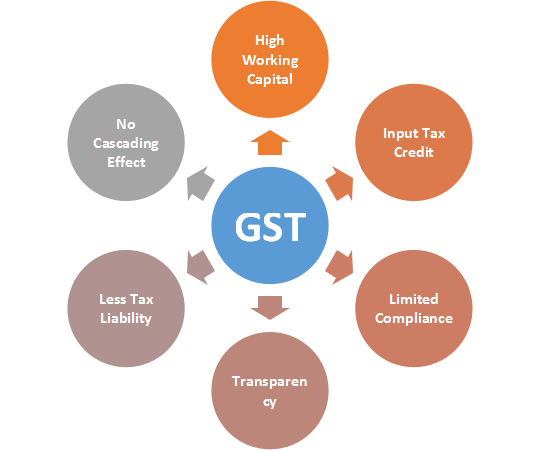

- Key advantages of GST registration:

So, we can clearly see how important GST registration is for both business and the economy. With the implementation of Goods and Services Tax regime, we are gradually moving towards a corruption-free India.

Try HostBooks

SuperApp Today

Create a free account to get access and start

creating something amazing right now!

5 Comments

I conceive this web site contains some really superb info for everyone :D.

I am continuously looking online for ideas that can facilitate me. Thanks!

Hello! Thank you for sharing such knowledgeable info about GST with us. I have read so many articles and I found you have explained GST in simple and laymen language Hoping you keep sharing such an informative blog in future too

Lots time i have been best information about gst and finance.

Wonderful post helped to know the guide on GST registration and online eligibility process. Thanks for sharing an useful post.